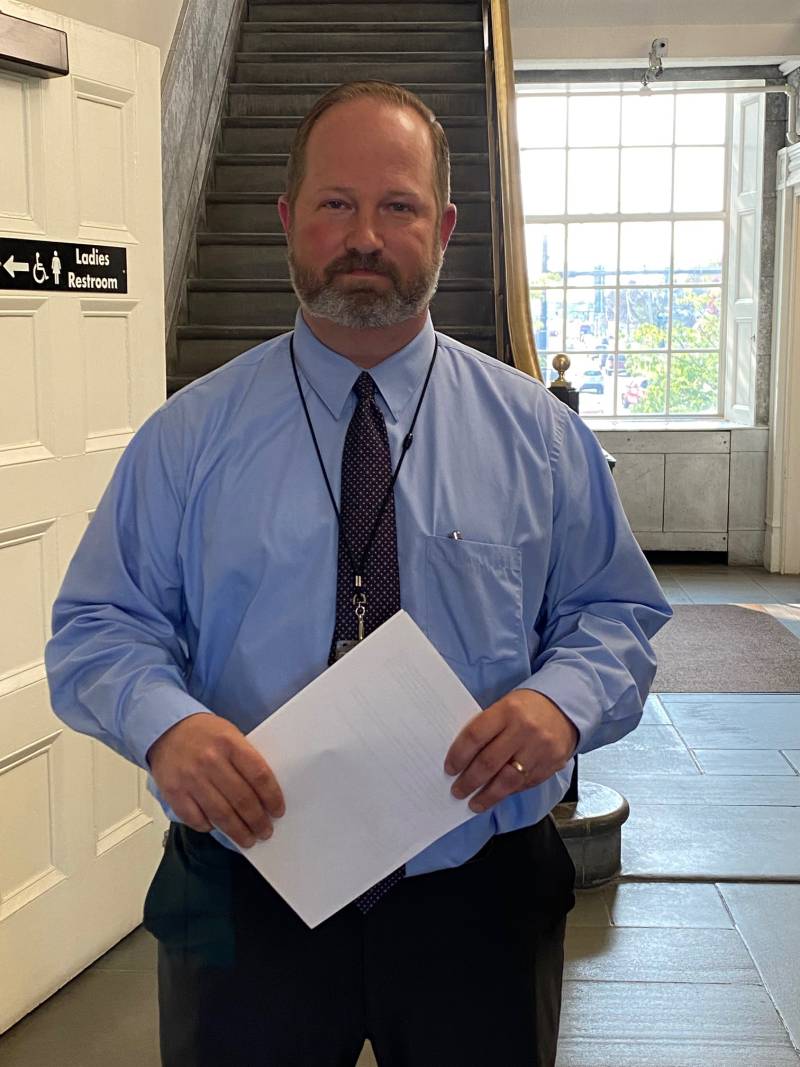

Photo by Joanne Beck

Lagging sales tax growth was the biggest challenge in drafting a proposed Genesee County budget, Matt Landers says. For 2025, the budget has tacked on $6.2 million more from this year’s total to accommodate several cost increases.

The county manager has carved out a budget of $189,249,435, which includes a tax rate of $7.57 — a 51-cent decrease from the current rate of $8.08 due to increased property assessments, he said this week.

“Large drivers of the increased budget were New York State retirement increases, health care cost increases, jail operating cost increases, preschool supportive health services program cost increases, assigned counsel cost increases, just to name some,” he said Monday to The Batavian.

A budget presentation will be held at 5:30 p.m. Wednesday in the Courthouse Chambers of the Old County Courthouse, 7 Main St., Batavia.

The budget increase is 3.4% more than from the 2024 adopted budget due to those increases and a lack of sales tax growth “to help offset the various cost increases,” Landers said.

If this budget is adopted by the county Legislature, it would mean an annual bill of $757 for a property assessed at $100,000, versus this year's tab of $808, for a decrease of $51 if a homeowner has not had a property assessment increase.

However, if a home's value went up from $100,000 to $125,000, it would mean that home that cost a yearly $808 would now cost $946.25, for an overall yearly increase of $138.25 due to that increased assessment.

A brand new $70 million county jail on Route 5 has meant a debt service for several years to come, and those payments began in 2023. However, there are other considerations to go along with the larger size and responsibilities of the facility, Landers said.

“The proposed budget has ten new correction officer positions created for the new county jail,” he said. “The medical costs at the jail are increasing due to the utilization of an additional contracted nurse in the 2025 budget.”

Which department raised the most concern in terms of cost?

“Jail, preschool supportive health services cost increases in which the county Public Health Department oversees, assigned counsel cost increases and 730 mental health restoration costs are all areas that continue to be closely monitored,” he said.

As an example of the increases, preschool program costs have gone from the 2024 budget of $2.7 million to the proposed 2025 budget of $4.6 million due to the program's rising demands and related costs of transportation, personnel, and benefits.

During his annual report to the Legislature in February, Public Health Director Paul Pettit discussed how transportation, in particular, was driving up pre-school costs, projecting a tab of nearly $1 million for busing alone in 2024.

Transportation and center program costs have been rising as an "underfunded mandate," Pettit had said.

“One of the drivers that’s really expensive is that more kids get referred. You probably saw on the governor's proposal she's proposing a 5 percent rate increase across the board. And then there's a 4 percent rider for rural counties, which we would fall under that bucket. So that'd be a 9 percent rate increase for early intervention,” he said. “And this is one of those programs that, again, we don't have a lot of control over the services that are provided.”

Landers has earmarked $1.14 million for preschool transportation in 2025. Mental health court is slated for an extra $200,000 in 2025, for a total of $500,000.

How is the water project fitting in -- debt service, the planning for work to be done this next year?

“Besides the annual $515,000 General Fund contribution to water from sales tax, which has been taking place for 20+ years, all operations of the water fund continue to be paid for out of operating revenues of the water fund,” he said. “Planning continues for Phase 3 of the water system.”

Circumstances may not have been perfect, but Landers is pleased with what he plans to present on Wednesday, he said.

“I am happy with the efforts made by my department heads and staff to deliver responsible budget requests that meet the demands of the community while providing quality service and do so in an efficient manner,” he said. “I would say the reduction in sales tax is a challenge that doesn’t present itself very often, which makes this budget a little more unique.”

The Legislature will meet on Nov. 13 to discuss the budget and include any public feedback to make further recommendations if necessary. The Ways & Means Committee will then review the budget and refer it to the full Legislature for vote. A vote to adopt the budget is scheduled for 5:30 p.m. Nov. 25 in Courthouse Chambers.