With a national movement to lessen diversity, potential funding, locals focus on 'safe and supportive' environments, NYS law

Uncertainty seems to be the sentiment of the moment — from local school and county officials to state senators — about recent presidential executive orders and an attempted funding freeze that was halted by a court order this week.

Two orders, titled Ending Radical Indoctrination in K-12 Schooling and Expanding Educational Freedom and Opportunity for Families, are posted on the U.S. government’s website and have not seemed to draw much public attention as of yet.

They involve the Education Department: divvying out funding for families to choose from a wider pool of public, private, faith-based, and military school options; and another order that pertains to less focus on diversity, equity and inclusion and bringing back “patriotic education” to the classroom.

The Batavian reached out to all eight of Genesee County’s public school superintendents and other county officials for responses to these and related orders, and the funding freeze, which Senators Chuck Schumer and Patty Murray not only publicly criticized this week but warned that the administration "will come back again and again and again” to try and implement some type of funding freeze, Schumer said.

Pembroke Superintendent Matt Calderón said, “certainly, I am always concerned about funding.”

“Because, as a small rural school with limited resources, we are already lean in regard to the programs we are able to offer, and we cannot afford to lose any of our current funding,” he said. “At the same time, I am not overly concerned about losing Pembroke students if educational options for families are expanded. I suspect we would lose some students and gain some students.

“As for the second order about restricting certain educational content, I don't believe this will have much impact on how we approach education in Pembroke due to the fact that we have never engaged in indoctrinating our students to subscribe to any specific ideology that may be politically motivated by either side of the aisle,” he said. “As educators, our responsibility is, in age-appropriate ways and in partnership with parents, to teach students about all the issues and perspectives that exist, to engage them in thinking and talking and reading and writing about those issues, with input from one another, from their parents, from community members, from experts and from an array of individuals who see things differently from one another.”

In addition to academics, he said that his district wants “to create a safe and supportive learning environment for all students regardless of who they are or what they believe.”

“We want to help students recognize and experience that they can co-exist, love and respect people who are different than they are and who may not view things the way they do,” he said. “We don't need the federal government or the state to dictate that we do this or how we do it because, ultimately, each school district is most accountable to its own local community.”

As for any future funding freeze that should come back into play, he and Le Roy School Superintendent Merritt Holly said that they do not have enough information or explanation about such a freeze from the federal level to make a statement about how it would affect their respective districts.

Batavia City Schools Superintendent Jason Smith agrees that “without details, the impact is hard to assess” for some of these measures, including the executive order pertaining to expanded school choice.

“This is yet to be determined how this would impact public school funding. Given our state aid is derived from student population and student need, this diversion of resources could potentially lead to greater inequality for public education,” Smith said. “Families do have choices now, and it is always difficult to make predictions when details are sparse.”

As for the order to end racial indoctrination, Smith was more definitive. Batavia City School District “is committed to protecting and serving all students, regardless of race, ethnicity, religion, or gender,” he said, adding his comments about reinstating patriotic education. “Local history is taught in fourth grade, and all seniors take a Participation in Government class, which is a NYS graduation requirement. In addition, United States History and Government is taught in Grades seven, eight, and 11, which follow the New York State Learning Standards for Social Studies.”

Since the funding freeze was “very broad, had few specifics, and was brief,” it is unclear at this time what the impact would have been, he said.

How would the district compensate for the loss if such a freeze is enacted down the road?

“The District would fund as much as possible through the general fund, but because these programs are funded through federal grants, the District's general fund could not sustain many of these programs, and there would need to be adjustments to the services provided to our students,” he said. “If the freeze is reinstated, the District would need to evaluate the programs funded through these federal grants and determine to the extent that they can be added to the general fund.”

Will you plan for such impromptu measures in this year's budget process?

While our budgets are built conservatively, and while we plan for worse-case scenarios, this would be an especially challenging situation,” he said. “So yes, to the extent possible, we will be planning for such measures.”

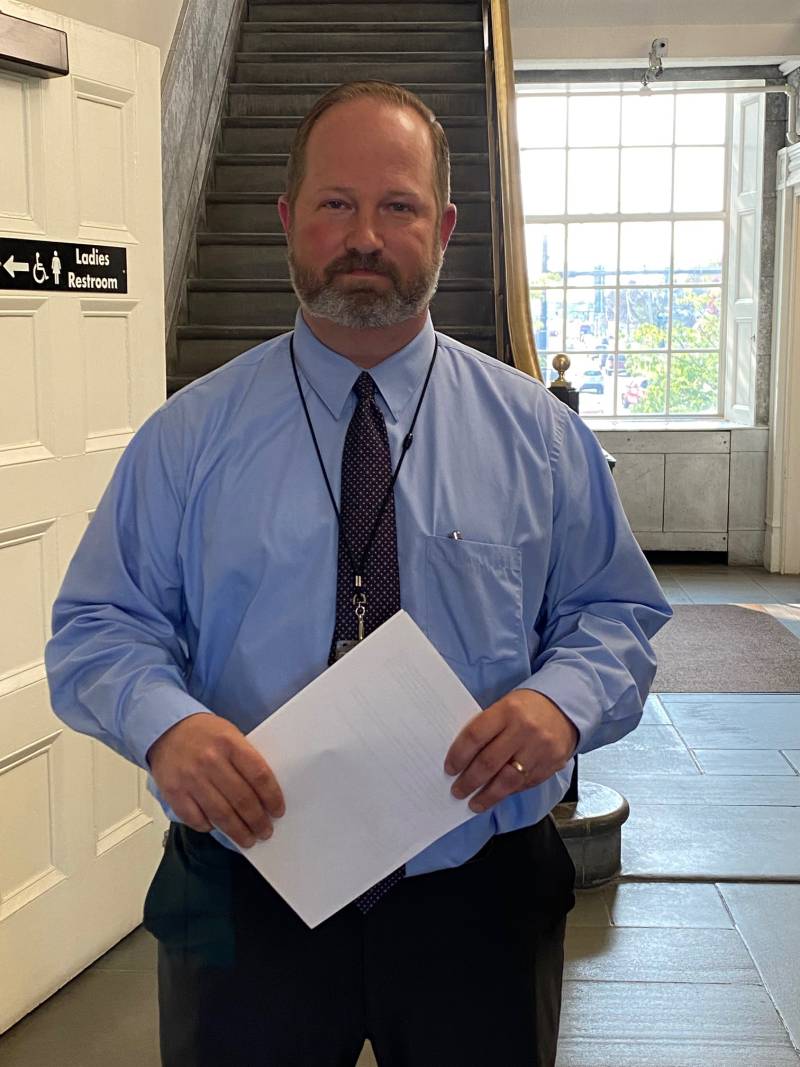

As with everyone else, County Manager Matt Landers didn’t know what the “true exposure is of a freeze” because he doesn’t yet have a good understanding of which areas would be selected for this measure, he said.

“I don’t want to speculate without more details. For example, the county receives federal monies for airport and bridge infrastructure projects, but I have not seen anything that indicates this funding could be in jeopardy, nor do I think those pots of money are under any particular scrutiny.

If, as Senator Schumer has predicted, the current presidential administration attempts again for a funding freeze, how would that affect Genesee County?

In the short term, the funding freeze could potentially impact cash flow for Genesee County government, but fortunately, we have a fund balance and cash reserves that should get us through this period,” Landers said. “I can’t speculate on how a permanent freeze would impact the County because we have numerous federal funding streams that affect different operations. Predicting which programs could be more than temporarily impacted would be just guessing at this point. Nonprofits in the community face a more difficult challenge if their federal funds get frozen because many of them operate on a shoestring budget where a delay in reimbursement could be devastating.”

How would you deal with it and recoup the loss? How much loss in funding could it mean?

“If the County were to lose federal funding, we would look to see if we could end the program that the funding supported,” he said. “Unless the program is mandated, in which case this would be another example of an unfunded mandate.”

Do you think that the DEI protocols/restrictions will be implemented on a local basis, and tied to funding? Your thoughts about that?

“Even if the federal government removes DEI language from their funding, NYS has equally or more stringent DEI policies in place, so I don’t anticipate much changing for county government,” he said.