Genesee County legislators knew one thing for sure after Wednesday’s budget presentation, Chairwoman Shelley Stein says.

They weren't yet ready to say how the Legislature was leaning toward a proposed $162.5 million budget with a 2 percent tax levy increase.

“We have one more budget session and we’re going to use it,” Stein said after the presentation and related public hearing.

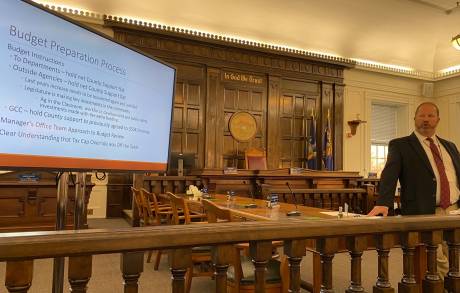

No one spoke up about the budget during the hearing. County Manager Matt Landers said it was the first budget in quite awhile that didn’t focus on the impacts of COVID. When drafting a budgetary plan — which he did with assistance from his support staff and the treasurer’s office — he looks at the net impact of all decisions.

“That’s what drives my red pen,” Landers said. “When I meet with the department heads, I want to know what the net impact of the county taxpayer is.”

There was a clear understanding that a tax cap override was “off the table,” as he worked with department heads to ensure that all spending was out of necessity, he said. Out of a $32 million tax levy, $25 million of that is for state mandated services, he said.

Of course, the elephant in the county room has been the new county jail, with a price tag of $70 million and a 30-year debt service payout schedule. Landers hasn’t been shy about discussing it, or admitting that it’s a huge chunk of money — about $4 million — to pay off each year.

“We’re trying to be smart, and not shock the system all at once,” he said.

The county is paying not only for the new facility expected to be ready in 2024, but is also designating $300,000 for the latter part of next year for eight new jail-related positions that include six correctional officers, a mechanic and a deputy jail superintendent.

Other full-time positions created in this proposed budget include an investigator and emergency services dispatcher for the Sheriff’s Office, a position in the Highway/Facilities Department for the jail, and a position in the Health Department (to be grant-funded).

“Some key investments that are being made in this budget, so there's public safety positions, there is the investigator in the Sheriff's Office. This is to better serve the public,” Landers said. “It was very bluntly said when talking to the sheriff when he was proposing this, there is an expectation when there's crimes committed in this community that our investigators can investigate these crimes in an inappropriate and timely fashion. The caseloads are starting to build up. So this is our response. It's a public safety request and a need in our community, and I have 100 percent of the Legislature’s support.”

He highlighted factors that will need to be monitored during the next fiscal year, such as sales tax revenues that are largely dependent on gasoline, and can be “volatile.” He also questioned the future and what may happen to those sales tax benefits once electric cars become more the norm and people aren’t buying gas as often.

An ongoing water project will mean spending an estimated $150 million for the next phase three on the horizon, though with labor, supply chain and inflation issues, that number could be upwards of $160 or $170 million, he said. Two union contracts will be coming up for negotiation next year as well, he said.

One part of the process that was not a challenge involved department personnel, he said. They didn’t balk at his suggestions or otherwise make the job more difficult.

“I cut from every single department,” he said.

Stein pointed out that the county’s public services — an area of significant focus in the budget — do come at a cost.

“We are a very conservative county. There is a continual balance between our quality of life here and the cost to our taxpayers. And the legislature that serves as an entire body keeps that balance right at the front of our minds,” she said. “And also, you will see that in our actions and in our questions, and in our commitment to providing the highest quality of life at a cost that is affordable. And we don't apologize for that.”

The levy increase would mean a tax rate decrease of 8 percent, going from $9.18 to $8.44 per $1,000 assessed value. That is due to the overall property assessment increases.

Legislators have until Nov. 21 to discuss the financial plan and vote to adopt it. Feedback and comments are always welcomed, Landers said.