Legislators are faced with a number of hard choices as the county's 2017 budget comes together.

Increases in mandated spending, increases in personnel expenses, flat sales tax revenue and unsettled questions about expenses related to the soon-to-be-former Genesee County Nursing Home means the county needs to raise more money than allowed by the tax levy cap.

County Jay Gsell laid out several options for the legislators, except one, but Chairman Ray Cinifrinit put it on the table: Voting to override the tax cap limit.

To override, the Legislators would have to hold a public hearing and then vote on a resolution. That would have to be done before completion of the budget process, so approving the resolution wouldn't necessarily mean there would be a tax increase above the cap amount.

"I'm suggesting that we at least pass the resolution," Cianfrini said. "That's just good planning."

Gsell said he won't submit a budget proposal, which is due within 48 hours, that includes a tax increase above the cap amount.

The formula for figuring the cap takes into account the $14 million in increased assessed value for real property in the county, but the county can only use a portion of that increase for any pre-cap increase in the levy.

If the county were to raise no more money from the levy than in 2016, it would put the tax rate for the county at $9.69 per thousand of assessed value.

The rate can't go past $9.86 to stay under the levy cap.

If Gsell accepted all of the funding requests by various county departments, which by direction were already frugal requests, the tax rate would be $10.27.

To get the rate down to at least $9.86, Gsell said there will be no new hires for county staff, except two new corrections officers, and he's looking at using $1 million from the county's reserves, as well as diverting 1 percent of the sales tax that would normally go to next year's capital projects (think roads and bridges), for another $800,000 in savings. He's also cutting 10 percent from all non-mandated services, except for mental health related services, Genesee Community College and the Chamber of Commerce (the tourism office helps generate revenue for the county and gets funding from the hotel bed tax).

Here's the list of programs and agencies slated for a 10 percent cut from their funding requests:

- GO-ART!

- Business Education Alliance

- Cornell Cooperative Extension

- Holland Land Office Museum

- Housing Initiative Committee

- Genesee County Economic Development Center

- Libraries

- Mercy Flight

- Soil & Water Conservation District

Legislator Andrew Young expressed concern about the county once again dipping into reserve funds to balance a budget. He noted that practice can't last forever. He is also concerned about diverting funds from capital projects when the county is looking at a $15 million bill for road and bridge repairs over the next five years.

So take those two revenue diversions off the table, that leaves Legislators with two big options -- raise taxes above the levy cap, or go to what Gsell called "the nuclear option," the "scorched earth policy."

That option is completely eliminating a service the county currently provides but isn't mandated by state law. Those options include closing county parks and eliminating the road patrol deputies in the Sheriff's Office.

Such drastic cuts could also include elimination all funding for the nine programs and services listed above.

"If they (the legislators) don't like what I recommend in terms of how the revenues are put together," Gsell said after the meeting, "that's when I have to go back to the expense side of the equation and get rid of $1 million to $2 million worth of expenses."

But Gsell warned legislators that drastic cuts will certainly bring about intense pushback from the community.

"We tried that with Genesee Justice a few years ago and I believe there were 200-plus people at a public hearing over in the court facility," Gsell said. "Everybody and the kitchen sink came in and said that's the worse thing the county has ever thought of, let alone tried to do as far as county government goes. So that's just a caution."

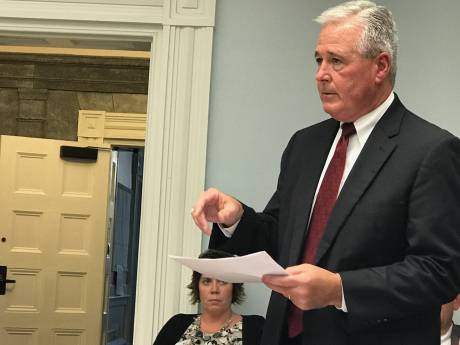

The two-and-a-half hour meeting Wednesday also included a lengthy discussion about how to eliminate some of the overtime costs within the Sheriff's Office. Sheriff Gary Maha, Undersheriff William Sheron (top photo), Chief Deputy Gordon Dibble and Jail Superintendent William Zipfel participated in the conversation.

The two main areas of overtime expense are deputies in training with their four-hour daily commute to and from basic training in either Niagara Falls or Monroe County and prisoner transport of female inmates between Genesee County, which doesn't have a jail that can house female inmates, and the jails in the area that can accept female prisoners.

Currently, deputies are taken off of road patrol for transports.

The Sheriff's Office budget requested three new corrections officers to handle the transports, but the discussion headed toward a proposal to hire two new corrections officers and find retired law enforcement officers to work part-time help with transports.

County Attorney Charles Zambito, soon-to-be County Judge Zambito, said once he's judge he can probably make sure the calendar is adjusted to ensure prisoners to be transported are scheduled for appearances in batches, reducing the number of transport trips.

Jail expense is also going up, Zipfel said, because of the changing demographics of the jail population. There is more time and expense with medical transportation and dealing with mental health issues, including more one-on-one watches for inmates who may be suicidal.

"The jail population is aging and getting sicker with every month that goes by," Zipfel said. "We're encountering more people who have drug and alcohol addictions, more people who are older. We've had several people recently in their 70s and 80s who are getting sentenced because of drug and alcohol addictions."

The legislature will meet again on the budget next Wednesday.

The two main areas of

The two main areas of overtime expense are deputies in training with their four-hour daily commute to and from basic training in either Niagara Falls or Monroe County and prisoner

Was that a typo; 4 hour daily commute to Niagara Falls or Monroe County?? Last I traveled to either place I made Rochester in about 35 minutes and Niagara Falls in less than an hour???

Here we go again, more

Here we go again, more political strong-arming by Mgr. Gsell. Diverting money from fixing "roads and bridges"... WRONG ANSWER! Then looking at the list provided for a 10% cut in funding, there is ONE essential service [Mercy Flight] which absolutely should NOT be included in the funding cuts, why is it there? On the other hand, ALL the other organizations [including parks] listed should be cut by even more than 10%, let the people who use those services pay for them... don't put the burden on all the county taxpayers, most of whom never use or benefit from them... and GCEDC SHOULD BE CUT OUT COMPLETELY! Let Cuomo pay for that fraud.

Cutting overtime in the Sheriff's department, as well as all county divisions should be very doable. Take a lesson from one of the most efficient companies around at cutting costs... the RTS Genesee Bus. It has been moving aggressively to an all part-time work force which includes substantially lower pay rates and no benefits, and they have no shortage of drivers or applicants.

Besides, have all avenues of Federal funding been fully explored? With the current progressive social services/welfare mindset that is in charge in DC it seems that there should be plenty of help with money for jail alternative rehab programs, mental health, and other social services.

Chairman Cianfrini says that looking at all options including a tax cap over-ride is "good planning"??? IMO when there is not enough money, "good planning" says cut spending.

How about hitting up The Clinton Foundation for money... ;<\