Tompkins Financial

Tompkins Financial Corp. reports record YTD and second quarter earnings

Press release:

ITHACA -- Tompkins Financial Corporation (NYSE American: TMP), parent company of Tompkins Bank of Castile, Tompkins Insurance Agencies, and Tompkins Financial Advisors, today reported record year-to-date and second quarter earnings.

The company also has announced that its Board of Directors approved payment of a regular quarterly cash dividend of $0.52 per share, payable on Aug. 14, to common shareholders of record on Aug. 3, 2020, and has authorized a new stock repurchase program.

Tompkins Financial Corporation reported diluted earnings per share of $1.44 for the second quarter of 2020, up 13.4 percent compared to $1.27 reported in the second quarter of 2019. Net income for the second quarter of 2020 was $21.4 million, compared to $19.4 million reported for the same period in 2019.

For the year-to-date period ended June 30, 2020, diluted earnings per share were $1.97, down 25.1 percent from the same period in 2019. Year-to-date net income was $29.4 million, down from $40.4 million, for the same period in 2019. Results for the 2020 year-to-date period were negatively impacted by economic stress resulting from the COVID-19 pandemic, which contributed to the $16.3 million provision for credit losses recognized during the first quarter of 2020.

"We are pleased to report strong financial results for the quarter despite a very challenging business climate," said Stephen S. Romaine, president & CEO. "Although the longer term impact of the pandemic and related economic conditions are still unknown, there have been several recent positive trends noted with certain national economic indicators, such as reduced levels of unemployment, improving retail sales and improving consumer confidence.

"At Tompkins, we have seen several positive trends as well, with very strong mortgage application volumes in the second quarter, higher levels of debit card spending, and favorable credit quality measures when compared to last quarter. We are encouraged by some of these recent favorable trends, though the recent rise in COVID-19 cases nationally makes it clear that much uncertainty remains. We will remain vigilant in monitoring risk trends as we navigate these challenging times.”

For full details, you can access the online versions through the links below.

- Tompkins Financial Corporation Reports Record Year-to-Date and Second Quarter Earnings

- Tompkins Financial Corporation Reports Cash Dividend

About Tompkins Financial Corporation

Tompkins Financial Corporation is a financial services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania. Tompkins Financial operates in Western New York as Tompkins Bank of Castile, Tompkins Insurance Agencies, and Tompkins Financial Advisors. Further information is available at www.tompkinsfinancial.com.

Tompkins Bank of Castile is a community bank with 16 offices in the five-county Western New York region. Services include complete lines of consumer deposit accounts and loans, business accounts and loans, and leasing. Further information about the bank is available on its website, www.bankofcastile.com.

Tompkins Insurance Agencies Inc., offers personalized service, local decision-making and a broad range of services for consumers and businesses. It is an independent insurance agency offering personal and business insurance and employee benefits services through more than 50 different companies. The firm operates six offices in Central New York, 16 offices in Western New York and seven offices in Southeast Pennsylvania. Further information is available at www.tompkinsins.com.

Tompkins Financial Advisors is the wealth management firm of Tompkins Financial Corporation. With more than a century of experience in helping clients to build, protect, and preserve wealth, Tompkins Financial Advisors provides financial planning, investment management, trust services and estate administration. For more information, visit www.tompkinsfinancialadvisors.com.

Sweet! Tompkins donates Oliver's Candy Bars to frontline workers at Rochester Regional Health

Submitted photo and press release:

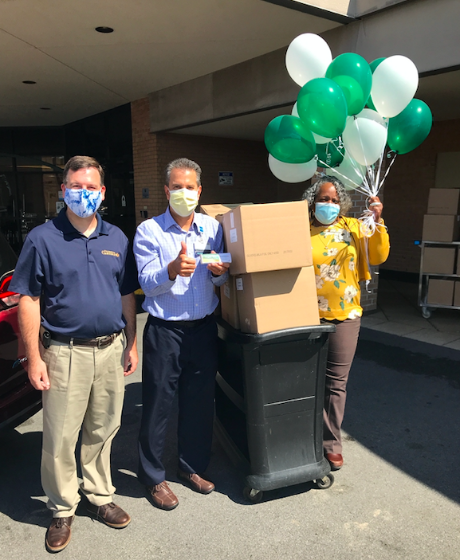

In an effort to brighten the day for local frontline workers during the COVID-19 pandemic, Tompkins Bank of Castile, Tompkins Insurance Agencies and Tompkins Financial Advisors donated 3,400 Oliver’s Candy Bars to the Rochester Regional Health Staff.

The sweet treat will be handed out to all employees as a way to say "Thank You!"

Pictured from left are: Steve Beardsley, senior vice president, Commercial Banking regional manager, presents Jim Creighton and Gina Burden-Rambert of Rochester Regional Health with 3,400 candy bars to distribute to their staff.

Tomkins Insurance Agencies hire commercial insurance account executive in Batavia

Tompkins Insurance Agencies is pleased to announce that Nick Mroz has been recently hired as a commercial insurance account executive.

He will serve the Western New York region out of the agency’s Batavia office at 90 Main St.

Mroz has 17 years of experience in the financial services and Insurance industry. He was formerly employed by Five Star Bank.

Mroz holds his Life & Health and Property & Causality insurance licenses, and FINRA series 6 and 63 securities licenses.

He attended Pierce Community College in Tacoma, Wash., and served in the Army.

Mroz and his family reside in Medina, where he is a member of the Medina YMCA, American Legion, and VFW.

Tompkins Financial Corporation reports record year-to-date and first quarter earnings

Press release:

ITHACA -- Tompkins Financial Corporation (NYSE American:TMP), parent company of Tompkins Bank of Castile, Tompkins Insurance Agencies, and Tompkins Financial Advisors, has reported record year-to-date and first quarter earnings.

Tompkins Financial Corporation Reports Cash Dividend

Tompkins Financial Corporation announced today that its Board of Directors approved payment of a regular quarterly cash dividend of $0.52 per share, payable on May 18, 2020, to common shareholders of record on May 11, 2020.

Tompkins Financial Corporation Reports First Quarter Earnings

Tompkins Financial Corporation announced net income attributable to common shareholders of $7.9 million, or $0.53 per diluted common share for the first quarter of 2020, compared to $21.0 million, or $1.37 per diluted common share, for the first quarter of 2019. Results for the first quarter of 2020 were negatively impacted by current economic stress resulting from the COVID-19 pandemic, which contributed to the $16.3 million provision for credit losses recognized during the quarter under the new current expected credit losses (CECL) accounting standard. Refer to "Asset Quality" section for further discussion of the impact on the Company's financial statements upon adoption of this new accounting guidance.

"These are clearly unprecedented times for our country and our communities. I am extremely proud of the exceptional way the Tompkins team has stepped up to the current environment by addressing the specific challenges of our clients and communities who are facing hardships due to the COVID-19 pandemic. Though these are unprecedented times, Tompkins enters this environment well prepared to face the many challenges and difficulties we are all dealing with as a result of the pandemic. Over recent years, we have invested significantly in digital technologies to improve capabilities that allow our customers to bank remotely. We have also invested significantly in our internal systems, which allowed nearly 100 percent of our non-retail employees to transition quickly and securely to remote working environments with limited disruption to our business. Furthermore, we entered 2020 with a strong financial position, coming off a year of record earnings per share in 2019, and with our 2019 Risk Based Capital Ratio at its highest level since 2014."

SELECTED HIGHLIGHTS FOR THE FIRST QUARTER:

Despite the decline in earnings from the prior year, there were several favorable trends noted during the first quarter of 2020, including:

• Total loans of $4.9 billion were up 3.1 percent over March 31, 2019

• Total deposits of $5.4 billion increased by 8.4 percent over March 31, 2019

• Noninterest bearing deposits of $1.4 billion increased by 5.6 percent over March 31, 2019

• Net interest margin was 3.44 percent for the first quarter of 2020, up from 3.34 percent for the first quarter of 2019, and 3.43 percent for the fourth quarter of 2019

NET INTEREST INCOME

Net interest margin was 3.44 percent for the first quarter of 2020, up compared to the 3.34 percent reported for the first quarter of 2019, and 3.43 percent for the trailing quarter ended Dec. 31, 2019. The improved net interest margin year-over-year was largely driven by lower other borrowing balances and funding costs, primarily in other borrowings. Net interest income of $53.0 million for the first quarter of 2020 was up 2.0 percent compared to the first quarter of 2019.

NONINTEREST INCOME

Noninterest income represented 26.4 percent of total revenues in the first quarter of 2020, compared to 27.2 percent in the first quarter of 2019. Noninterest income of $19.0 million was down 2.3 percent compared to the same period in 2019. Noninterest income in the first quarter of 2019 included a one-time incentive payment of $500,000 (pre-tax) related to our card services business.

NONINTEREST EXPENSE

Noninterest expense was $45.7 million for the first quarter of 2020, which was up 3.5 percent from the same period in 2019, and in line with the fourth quarter of 2019. The increase in noninterest expense from the same period last year was mainly related to higher salaries and wages in the first quarter of 2020, largely reflective of merit increases awarded in 2019.

INCOME TAX EXPENSE

The Company's effective tax rate was 19.4 percent in the first quarter of 2020, compared to 21.0 percent for the same period in 2019.

ASSET QUALITY

Asset quality trends remained strong in the first quarter of 2020. Nonperforming assets represented 0.46 percent of total assets at March 31, 2020, down slightly from 0.47 percent at Dec. 31, 2019. Nonperforming asset levels continue to be below the most recent Federal Reserve Board Peer Group Average1of 0.56 percent.

Net charge-offs for the first quarter of 2020 were $1.2 million compared to $3.5 million reported in the first quarter of 2019. Net charge-offs of $1.2 million in the first quarter of 2020 was largely related to a single credit, while the first quarter of 2019 included a $3.1 million write-down of one credit, both in the commercial real estate portfolio.

The Company adopted Accounting Standards Update (“ASU”) 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” (“CECL”), effective Jan. 1, 2020. The Company recorded a net increase to retained earnings of $1.7 million upon adoption of the new standard. The transition adjustment at Jan. 1, 2020 included a $2.5 million decrease in the allowance for credit losses on loans, and a $0.4 million increase in the allowance for credit losses on off-balance sheet credit exposures, net of the corresponding $0.4 million decrease in deferred tax assets. The provision for credit losses for the first quarter of 2020 was $16.3 million, increasing the allowance for credit losses to $52.4 million at March 31, 2020. The increase in the first quarter of 2020 was not a direct result of specific credit risks currently identified in the loan portfolio; rather, the increase was largely a result of the impact of the current economic shutdown related to COVID-19 on economic forecasts and other model assumptions relied upon by management in determining the allowance.

The allowance for credit losses represented 1.06 percent of total loans and leases at March 31, 2020, compared to 0.81 percent at Dec. 31, 2019, and 0.84 percent at March 31, 2019. The ratio of the allowance to total nonperforming loans and leases was 170.74 percent at March 31, 2020, compared to 126.90 percent at Dec. 31, 2019, and 175.51 percent at March 31, 2019.

CAPITAL POSITION

Capital ratios remained well above the regulatory minimums for well capitalized institutions. The ratio of Tier 1 capital to average assets was 9.53 percent at March 31, 2020, down slightly from 9.61 percent at December 31, 2019, and improved from 9.24 percent at March 31, 2019. Consistent with the Company's capital planning practices, during the quarter ended March 31, 2020, the Company repurchased 71,288 shares of common stock at an average price of $78.83 per share. On March 19, 2020, following the announcement of the national emergency related to the COVID-19 pandemic, the Company suspended the purchase of shares under the Company’s share repurchase program. During the quarter ended Dec. 31, 2019, the Company repurchased 35,821 shares of common stock at an average price of $80.25 per share. There were no shares repurchased during the first quarter of 2019.

IMPACT OF, AND RESPONSE TO, COVID-19 PANDEMIC

Economic Environment

The COVID-19 outbreak has led to government-mandated closures and stay at home orders across the nation, which have resulted in deteriorating economic conditions throughout the U.S. The various government orders issued in response to the pandemic are significantly impacting the U.S. labor market, consumer spending and business investments. During March 2020, in response to the deteriorating economic conditions, the Federal Reserve reduced the federal funds rate 1.5 percentage points, to .00 to .25 percent. The Federal Reserve also provided a pandemic-related stimulus package estimated at $4.0 trillion, in order to ease the stress on financial markets. In addition, the United States Congress passed the Coronavirus Aid, Relief and Economic Security Act ("CARES Act"), which would provide approximately $2.5 trillion of support to U.S. citizens and businesses affected by COVID-19.

Company Response

During the first quarter of 2020, the Company designated a Pandemic Planning Committee, made up of members of Senior Management, to oversee the Company’s response to COVID-19. The Company implemented a number of risk mitigation measures designed to protect our employees and customers, while maintaining services for our customers and community. These measures included restrictions on business travel and establishment of a remote work environment for all non-customer facing employees. The Company also implemented drive-up only or by appointment only operations across its branch network.

Currently, over 85 percent of our workforce is working remotely and we have imposed social distancing restrictions and provided premium pay for those employees who are required to be on premise to complete essential on-site functions. Due to the significant uncertainty of the current economic climate, and the Company's ongoing response to the pandemic and related shutdowns, annual pay increases for our Company's executive officers (which is comprised of our Senior Leadership Team members) have been deferred indefinitely.

As previously announced, Tompkins has initiated and participated in a number of credit initiatives to support employees and customers who have been impacted by the shutdown associated with the COVID-19 pandemic. For non-executive employees affected by COVID-19, the Company implemented a low interest loan program. The Company also implemented a payment deferral program to assist both consumer and business borrowers that may be experiencing financial hardship due to COVID-19. The current standard program allows for the deferral of loan payments for up to 90 days and customers will be able to request a payment deferral until the middle of May 2020. As of April 20, 2020, the Company had granted payment deferral requests for approximately 2,800 loans to individuals and businesses.

The Company is participating in the U.S. Small Business Administration (SBA) Paycheck Protection Program (“PPP”). This program provides borrower guarantees for lenders, as well as loan forgiveness incentives for borrowers that utilize the loan proceeds to cover employee compensation-related expenses and certain other eligible business operating costs, all in accordance with the rules and regulations established by the SBA. The Company began accepting applications for PPP loans on April 3, 2020, and has approved approximately 2,900 loans totaling about $500 million.

Mr. Romaine added, “We enter the second quarter of 2020 in a period of significant uncertainty surrounding the COVID-19 pandemic and related economic shut-downs. Our long held philosophy of maintaining Tompkins as a sustainable high performing company, supported with prudent risk management practices, is now more important than ever. We believe our healthy capital and liquidity positions will provide flexibility to respond to current challenges. The overall impact of COVID-19 on our consolidated results of operations for the three months ended March 31, 2020 was limited, with the exception of our provision for credit losses. We did see some slowdown toward the end of the first quarter in other areas of our business, including reduced transaction volumes in our card services business, a decrease in wealth management fees due to the decline in financial markets, and decreases in certain other fee related income. However, the extent to which the COVID-19 pandemic will affect our business, results of operation and financial condition going forward is difficult to predict and depends on numerous evolving factors.”

There is currently a great deal of uncertainty regarding the length of the COVID-19 pandemic and the efficacy of the extraordinary measures being put in place to address it. If efforts to contain COVID-19 are not as successful as anticipated, if restrictions on movement last into the third quarter or beyond, or if the federal government's economic stimulus packages are ineffective or delayed, the current economic downturn will likely be much longer and much more severe. The deeper the economic downturn is, and the longer it lasts, the more it will damage consumer fundamentals and sentiment. Similarly, an extended global recession due to COVID-19 would weaken the U.S. recovery and damage business fundamentals. As a result, the pandemic and its consequences, including responsive measures to manage it, have negatively impacted, and may continue to negatively impact, demand for and profitability of our products and services, the valuation of our assets, the ability of borrowers to satisfy obligations, and our ability to meet the needs of our customers, all of which could have a material adverse effect on our business and financial performance.

ABOUT TOMPKINS FINANCIAL CORPORATION

Tompkins Financial Corporation is a financial services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania. Headquartered in Ithaca, NY, Tompkins Financial is parent to Tompkins Trust Company, Tompkins Bank of Castile, Tompkins Mahopac Bank, Tompkins VIST Bank, Tompkins Insurance Agencies Inc., and offers wealth management services through Tompkins Financial Advisors. For more information on Tompkins Financial, visit www.tompkinsfinancial.com.

Tompkins Bank of Castile to aid its employees affected by COVID-19 pandemic

Press release:

In an effort to assist its employees with unexpected financial burdens faced during the current COVID-19 crisis, Tompkins Financial is offering a discount loan program to non-executive Tomkins employees who have encountered increased expenses or decreased income. These include spouse or domestic partner’s job loss, and unexpected costs for elder care or child care.

In addition, Tompkins has instituted a premium of up to 25 percent additional pay for employees whose essential work requires them to be on-site.

“Banks have been deemed to provide an essential service to our customers and communities and this is a way we can show our appreciation to our employees,” said John McKenna, president and CEO. “We understand that while we as a company are fortunate enough to maintain our workforce during this time, our team members may have spouses or partners who experience job loss.

"We also appreciate that they may experience unexpected costs related to the pandemic. We want our team members to know that Tompkins is standing by them in the same way they are standing by our customers.”

The premium pay model will apply to both exempt and non-exempt non-executive employees whose work requires them to report to a Tompkins location to perform essential job duties.

About Tompkins Bank of Castile

Tompkins Bank of Castile is a community bank with 15 offices in the six-county Western New York region. Services include complete lines of consumer deposit accounts and loans, business accounts and loans, and leasing. In addition, insurance is offered through an affiliate company, Tompkins Insurance Agencies, Wealth management, trust and investment services are provided through Tompkins Financial Advisors. Further information about the bank is available on its website, www.bankofcastile.com.

Tompkins Financial implements new Loan Assistance Program for commercial clients

Press release:

In an effort to assist current business customers with unexpected financial burdens faced during the current COVID-19 crisis, and on the heels of its recently announced relief for consumer loan customers, Tompkins Financial has implemented a loan assistance program for its eligible commercial clients.

Tompkins’ new Loan Assistance Program provides up to 60 days of deferment for all commercial loans.

“We understand that companies, including our small business customers, are the backbone of the U.S. economy and that they need our support during this critical time more than ever,” said Stephen Romaine, president and CEO. “As a community bank, it is our duty to assist businesses in the best way we can, which includes taking a market-leading position on loan deferment that we hope will inspire others to do the same during this time of unexpected hardship.”

Tompkins announced late Wednesday that it would provide this program as well as loan relief options to retail customers, preceding New York State’s announcement Thursday. Loan customers who are experiencing challenges with loan repayment should contact their banker via phone or email immediately, or reach out to Tompkins’ Customer Care Center at 1-888-300-0110 to review options that may be available to them.

About Tompkins Financial Corporation

It is a financial services company serving the Central, Western, and Hudson Valley regions of New York and the Southeastern region of Pennsylvania. Headquartered in Ithaca, NY, Tompkins Financial is parent to Tompkins Trust Company, Tompkins Bank of Castile, Tompkins Mahopac Bank, Tompkins VIST Bank, Tompkins Insurance Agencies Inc., and offers wealth management services through Tompkins Financial Advisors. For more information on Tompkins Financial, visit online.

Tompkins Financial Corporation announces stock repurchase program

Press release:

ITHACA -- Tompkins Financial Corporation (NYSE American:TMP)

Tompkins Financial Corporation announced today that its Board of Directors has authorized a new stock repurchase program of up to 400,000 shares of the company's outstanding common stock, par value $0.10 per share. This program replaces the company's existing 400,000 share repurchase program announced on July 20, 2018.

The new stock repurchase program is expected to be completed over the next 24 months.

The shares may be repurchased from time to time in open market transactions at prevailing market prices, in privately negotiated transactions, or by other means in accordance with federal securities laws. The actual timing, number and value of shares repurchased under the program will be determined by management at its discretion and will depend on a number of factors, including the market price of the Company's stock and general market and economic conditions, and applicable legal requirements.

"Safe Harbor" Statement under the Private Securities Litigation Reform of 1995:

This press release may include forward-looking statements with respect to revenue sources, growth, market risk, and corporate objectives. The Company assumes no duty, and specifically disclaims any obligation, to update forward-looking statements, and cautions that these statements are subject to numerous assumptions, risks, and uncertainties, all of which could change over time. Actual results could differ materially from forward-looking statements.

Tompkins Financial Corporation is a financial services company serving the Central, Western, and Hudson Valley regions of New York and the southeastern region of Pennsylvania.

Headquartered in Ithaca, Tompkins Financial is parent to Tompkins Trust Company, Tompkins Bank of Castile, Tompkins Mahopac Bank, Tompkins VIST Bank, Tompkins Insurance Agencies Inc., and offers wealth management services through Tompkins Financial Advisors.

For more information on Tompkins Financial, visit www.tompkinsfinancial.com.

Tompkins Bank of Castile and Tompkins Insurance donates $150K toward Healthy Living Campus

Submitted photo and press release:

With the YMCA fundraising underway, Tompkins Bank of Castile and Tompkins Insurance generously donated $150,000 to the Healthy Living Campus Capital Campaign in a check ceremony Thursday (Dec. 12).

Their gift is in celebration of their 150th Anniversary serving the community. The YMCA wishes continued success for Tompkins Bank of Castile and Tompkins Insurance as both of our organizations work together to provide opportunities for the Genesee County area.

The Healthy Living Campus will be transformational for Downtown Batavia and benefit community residents as the new facility will have:

• Accessibility for the handicap;

• State of the art indoor playground;

• Splash pad;

• Teaching kitchen;

• Indoor track;

• Preschool wing;

• Pickup and drop-off for kids;

• Larger gym;

• New programs with the United Memorial Medical Hospital including working with physicians, dietitians, nutritionists, survivor programing to name a few.

Tompkins, one of the largest employers in the City of Batavia, pledged the money this spring.

“This project will be transformational for downtown Batavia and benefit thousands of community residents for many years to come,” said John McKenna, president and CEO of Tompkins Bank of Castile, in March.

“We’re excited to play a pivotal role in a project that is going to bring such positive change to the community,” David Boyce, president and CEO of Tompkins Insurance, added at that time.

The donation will support a $22.5 million land redevelopment project that includes the current YMCA and United Memorial Medical Center (UMMC) Cary Hall on Main Street in Batavia. The initiative will have a substantial impact on Main Street, which is home to the headquarters of Tompkins Bank of Castile and Tompkins Insurance Agencies.

This community initiative is expected to boost the regional economy by about $60 million over the course of its first decade, including jobs at the new campus and during construction, according to the Genesee County Economic Development Center.

Top photo, from left: John McKenna, president and CEO of Tompkins Bank of Castile; Rob Walker, GLOW YMCA chief executive officer; and David Boyce, president and CEO of Tompkins Insurance.

Tompkins Financial is Benefactor Sponsor for GCC Foundation's 'Evening of Elegance' Dec. 7

Press release:

Genesee Community College Foundation is proud to announce that Tompkins Financial, one of the community's leading financial services companies, is the Benefactor Sponsor of "Encore: An Evening of Elegance," which is scheduled for Saturday, Dec. 7, at 6 p.m. in the Richard C. Call Arena at GCC's Batavia Campus.

The proceeds from Encore, the Foundation's premiere fundraising event, directly benefit the scholarship program at Genesee Community College.

Scholarships recognize academic excellence, keep talented students within the GLOW community, ease financial hardships for students and prepare students for careers in occupations that are critical to this region's growth.

"Tompkins is pleased to be the lead sponsor of this important event and to celebrate the importance of GCC to our community, and its students as our future leaders," said David S. Boyce, Tompkins Insurance president and CEO.

Since its inception nearly 30 years ago, Encore has provided a fun and festive opportunity for the community to gather in the fine spirit of the holiday to raise funds for student scholarships. In 2018, the Foundation awarded more than $145,000 in scholarships to GCC students in financial need.

This year's event is co-chaired by Mary Blevins and Jenna Holota.

With guests wearing their stylish cocktail attire, "An Evening of Elegance" includes the following:

- Cocktail Hour with DSP Jazz Trio (6 p.m.)

- Dinner Reception with sensational food stations (7:15 p.m.)

- Holiday Favorites and Pop Music by Nik and the Nice Guys (8-10 p.m.)

- Delectable Desserts (8:30 p.m.)

Tickets cost:

- $1,000 -- Holiday Chord Circle (for six tickets)

- $600 -- Golden Guitar (for four tickets)

- $300 -- Inner Circle (for two tickets)

- $100 -- Platinum Patron (single ticket)

Tickets to attend Encore 2019 are on sale now here, or through the Foundation Office at (585) 345-6809, or foundation@genesee.edu.

Tompkins Insurance awarded for National Excellence in Social Media

Press release:

Tompkins Insurance Agencies has received the 2019 Excellence in Social Media Award from the National Association of Professional Insurance Agents (PIA). The award was presented September 20, 2019 at a gala ceremony held in conjunction with PIA’s Board of Directors meeting in Orlando, Fla.

The award honors a PIA member agency that uses nontraditional communication tools to effectively further the goals of the organization.

“Our goal was to create a social media presence that is professional, credible, interesting, visually pleasing, educational, and tells our story in a compelling way," said David S. Boyce, Tompkins Insurance president and CEO. "This award validates the success of our efforts, and we are proud to be honored in this way."

The 2019 PIA National Excellence in Social Media Award was sponsored by the National Insurance Producer Registry (NIPR).

“One of the first groups to fully embrace social media, a few years ago, was independent insurance agents,” said Lauren G. Pachman, esq., PIA National counsel, director of regulatory affairs and a board member of NIPR. “In fact, PIA National was one of the first groups anywhere to bestow an award for excellence in social media, beginning in 2010.”

“Since that time, we’ve seen an increase in the sophistication—and the positive results—of the use of social media marketing by independent insurance agencies,” Pachman said. “Today, we honor a PIA agency that has taken agency social media marketing to the next level, the winner of the 2019 PIA National Excellence in Social Media Award, Tompkins Insurance Agencies.”

About Tompkins Insurance Agencies Inc.

Founded in 1875, Tompkins Insurance Agencies Inc. is an independent insurance agency offering personal and business insurance and employee benefits services through more than 50 different companies.

The firm operates 17 offices in Western New York, seven offices in southeast Pennsylvania, and six offices in Central New York. A part of Tompkins Financial Corporation, (trading as TMP on the NYSE - MKT), the agency is affiliated with Tompkins Bank of Castile, Tompkins VIST Bank, Tompkins Trust Company, and Tompkins Financial Advisors. Further information is available at www.tompkinsins.com.