Collins mum on substance of insider trading charges, refuses to take questions at press conference

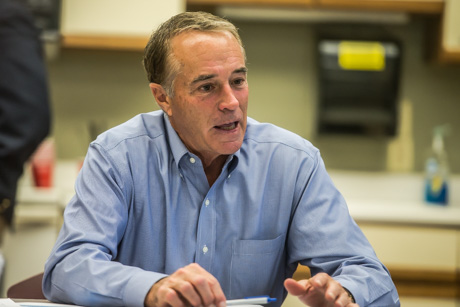

With barely a mention of the insider-trader charges he is facing, Rep. Chris Collins held what was billed as a press conference at the Embassy Suites in Buffalo on Wednesday evening and vowed to fight vigorously to clear his name.

He called the charges -- detailed at length earlier Wednesday in a 22-page Securities and Exchange Commission civil complaint -- "meritless" but offered no details on why he believes he has been unfairly charged.

With his wife, Mary Sue, standing placidly by his side, Collins held forth for nearly seven minutes on: his successes in business; his record as Erie County executive; his belief in the company at the heart of the insider trading allegations -- Innate Immunotherapeutics Ltd.; and his hope of finding a treatment for secondary progressive multiple sclerosis.

"I believe I acted properly and within the law at all times with regard to my affiliation with Innate throughout my tenure in Congress," Collins said. "I have followed all rules and all ethical guidelines when it comes to my personal investments including those with Innate.

"I look forward," he added later, "to being fully vindicated and exonerated, ending any and all questions relating to my affiliation with Innate."

After vowing that his name will be on the ballot for the NY-27 election in November, Collins walked off stage and refused to acknowledge reporters' questions.

The man prosecuting Collins, Geoffrey Berman, U.S. Attorney for the Southern District of New York, a Trump appointee, was far more detailed in a press conference in New York City earlier in the day. Berman and other federal law enforcement officials talked for nearly 30 minutes about the scheme they allege Collins enabled by his failure to keep confidential information he was legally and ethically bound to not share with anyone, not even his son.

According to Berman, however, as soon as Collins received the devastating news that a clinical trial for a promising MS drug developed by Innate had failed, Collins -- while attending a Friday afternoon Congressional picnic at the White House -- repeatedly attempted to call his son, Cameron Collins, a major shareholder of Innate stock. When he finally reached him -- while Collins was still pacing on the lawn of the White House -- father and son spoke by phone for six minutes.

That unleashed, Berman said, a frenzied four days of insider trading as the "tip tree" allegedly headed by Collins, got to work passing on info and dumping stock as soon as each member of the tip tree found out about the failed trial. Cameron managed to unload more than $570,900 in Innate stock that would become nearly worthless once the results of the trial were finally released the night of June 26, a Monday, by Innate.

"Congressman Collins couldn't keep his crime a secret forever," Berman said. "The FBI asked to interview him. And instead of telling the truth, he lied. And so did Cameron Collins and so did Stephen Zarksy. By lying to the FBI, they compounded their insider-trading crime with the crime of criminal cover-up."

The tip tree allegedly involved Cameron's girlfriend, a CPA, her father, her mother, along with other friends and family members.

Cameron Collins' girlfriend, Lauren Zarsky, and her mother, Dorothy Zarsky, have already settled with the SEC, admitting to their role in the insider-trading scheme and promising to pay back their "ill-gotten gains." Lauren Zarsky will also be prohibited from working as a CPA before the commission for five years.

"Accountants who engage in illegal insider trading should not serve in the role of gatekeeper in our securities markets," said Stephanie Avakian, co-director of the SEC.

The investigation into the alleged tipping tree began, according to Steven Peikin, head of the enforcement division of the SEC, after regulators noticed the unusual trading pattern of Cameron Collins.

According to the civil complaint, Cameron Collins, who at one time owned 5.2 million shares of Innate stock, initiated dozens of trades in increments small enough to avoid depressing the stock price but at high enough volumes that he could quickly unload all of the Innate stock he held in a U.S. brokerage.

"When members of the market abuse unit, a specialized group within the division of enforcement, uncovered suspicious trading by Cameron Collins they did not stop there," Peikin said. "As you heard, they identified well-timed trades by people close to him including his girlfriend, her mother, her father and her father's relative and a friend."

According to Peikin, numerous investigators with the SEC, the FBI and the U.S. Attorney's office worked on the case tirelessly for months, compiling a growing body of evidence that led them to Chris Collins, his son, the Zarsky family and their friends.

"(They) developed a thorough and compelling evidentiary record," Peikin said. "That record, which is summarized in the complaints, consists of e-mails and text messages, cell phone records, trading data, communications, including recorded calls with brokerage firms, IP log-on information and other (information). It reflects frantic efforts by tippers to convey inside information and traders to sell their shares before the company's negative news announcement."

Attorneys for Chris Collins tried to make the case Wednesday that Collins is not guilty of insider trading because he did not sell any of his own stock in the company. During his time on the dais at Embassy Suites on Wednesday evening, talking in front of about 30 reporters, Collins echoed the sentiment.

"When it became clear that the drug I and others believed in fell short of our hopes and expectations, I held on to my shares rather than sell them as a result," Collins said.

It's not part of the allegation against Collins that he engaged insider trading by selling stock, however. The allegation is that he initiated a tip tree that caused others to sell based on information he was duty-bound to keep confidential.

"Congressman Collins had an obligation and a legal duty to keep that information secret until that information was released by the company to the public," Berman said. "But he didn't keep it secret. Instead, as alleged, he decided to commit a crime. He placed his family and friends above the public good. Congressman Collins was a major investor in Innate and so was his son, Cameron. The congressman knew he couldn't sell his own shares for personal and technical reasons, including that he was already under investigation regarding Innate by the Congressional Ethics Office."

At the time Chris Collins was informed by the Innate CEO via an email that the clinical trials had failed, all of the stock held by Collins was tied up in an Australian brokerage. In May of 2017, Collins attempted to transfer his stock holdings to a U.S. brokerage, according to the civil complaint, but a mistake in the form delayed the transfer. Cameron Collins completed his own transfer between countries in early June. Once Innate knew it would be making a material announcement about the company, under Australian securities rules, trading of the stock was suspended. That rule didn't apply to the stock held by Cameron Collins once it was transferred to a U.S. brokerage or the other alleged members of the tip tree, so they were able to offer their stocks for sale as a penny stock on the over-the-counter Pink market under the ticker symbol INNMF.

The SEC takes a dim view of insider trading because trust is an important component of an open securities market. When traders buy or sell stock in a company based on information not available to the general public, it violates that trust.

"Insider trading is not just illegal," Peikin said. "It is also corrosive. It threatens investor confidence in the fairness and integrity of our markets. For our capital markets to retain their place as the envy of the world, the SEC and its law enforcement colleagues must be vigilant in policing against this misconduct."

Joshua Dent, president of Dent Wealth Management in Batavia, said that is exactly the attitude he expects from the SEC and it's critical to how he and his colleagues do their jobs. They need to know the securities they recommend to investors are being traded honestly and fairly.

"Stocks are traded on information and it's critical for that information to be accurate," Dent said. "Companies can get in trouble for falsifying that information to investors. At the same time, access to that information must be open to all investors or it gives some individuals an unfair advantage. Anything that causes investors to mistrust the fairness of the market is dangerous and threatens the integrity of the entire stock market."

While anybody who bought Innate stock at the time Cameron and others were selling may have lost money on the trade, it's impossible to say that they lost money because the alleged insiders were selling. The buyers were all willing buyers, Dent explained. They probably would have been looking to purchase stock in Innate even if the alleged insiders hadn't been trading. If they bought at the share price available -- about 45 cents at the time -- they would have lost their shirts by June 27 regardless of who was selling the stock. They traded on the information available to the general public and likely would have made those trades even without the alleged insiders trading.

"There's no recourse for them because they could have bought the stock from anybody and they were willing to buy at that price," Dent said. "It's not necessarily about the victims as much as the unfairness that the Collins's were able to avoid losses and threaten the credibility of the market. The victims are basically all investors because if some people are able to receive and act on insider information and others cannot, then, as I said, it threatens the credibility of the stock market. The credibility of the stock market is based on the ability of investors to trust a fair exchange."

Chris Collins, Cameron Collins, and Stephen Zarsky each face 13 counts of securities fraud, wire fraud, and making false statements. If convicted, they each could be looking at five years in prison.

As a result of his arrest in Manhatten this morning, Collins is already facing consequences in the House of Representatives. Speaker Paul Ryan removed Collins from the House Energy and Commerce Committee.

“While his guilt or innocence is a question for the courts to settle, the allegations against Rep. Collins demand a prompt and thorough investigation by the House Ethics Committee," Ryan said. "Insider trading is a clear violation of the public trust. Until this matter is settled, Rep. Collins will no longer be serving on the House Energy and Commerce Committee.”

During today's press conference in New York City, Co-director of the SEC Avakian addressed those tempted by insider trading.

"Here's a better inside tip for those who think they can play by a different set of rules: Access to this kind of information carries with it significant responsibility, especially for those in society who hold a position of trust, to act honorably and in accordance with the law, and do not lie to special agents of the FBI," she said.

Video: Chris Collins "press conference" in Buffalo on Wednesday evening:

CBS News carried the press conference about the charges against Collins live. In the video below, the press conference starts at about the 6:45 mark.

CBS News also obtained exclusive video taken at the White House on June 22 during the Congressional picnic. It shows Collins on the phone at 7:17. The email informing board members of the failed clinical trials went out at 6:55 p.m. Collins allegedly tried multiple times to get in touch with Cameron Collins and when finally did, they allegedly spoke to each other for about six minutes.

CORRECTION: Earlier we referred to the document used in this story as a "criminal complaint." The document in the possession of The Batavian at the time this story was written was actually from the SEC and is a civil complaint. There is also a federal indictment that The Batavian had not yet obtained when this story was written.