genesee county

County Highway superintendent provides more details on cost savings if county hires vendor to supply fleet vehicles

County legislators were filled in on a few more details Wednesday on a proposal that could save the county money on its motor vehicle fleet by County Highway Superintendent Tim Hens.

Hens wasn't able to attend the Public Service Committee on Tuesday where the proposal was first pitched to legislators, but he was at Wednesday's Ways and Means Committee meeting.

"It's also important to look at that it's not only $80,000 savings on the bottom line, we're also providing a higher level vehicle to departments," Hens said. "In the current fleet mix we have now, we have a number mid-size, almost compact-size cars that departments are using. ... We're providing across-the-board vehicles to departments more suited to what they want and fits department usage and we're still saving $80,000."

There could be more potential cost savings down the road, Hens said, if the program with Enterprise Rent-A-Car works out and the county converts more of its vehicles, such as County Highway pickup trucks, to the program.

The current proposal calls for Enterprise to replace 47 vehicles currently in the county fleet with 47 new vehicles. Enterprise would sell the used vehicles and return the proceeds to the county (as much as $580,000) and the county would make payments on the new vehicles.

One reason the deal works for the county, Hens explained, is that the vehicles the county will get from Enterprise every four years will be cars, SUVs and vans that have higher resale value than the typical Ford the county gets now (nothing against, Ford, Hens noted, but they don't have great resale value).

"The only difference, really the big difference, is that they are getting just a smidge bit better purchasing prices because they're buying so many vehicles nationwide and where they're really beating us is on resale," Hens said.

Currently, when the county retires a vehicle, it's sold through one of two regional auction houses, limiting the size of the potential buyers' market.

"These guys are selling their vehicles at an Enterprise fleet auction that's covering all of North America so they're driving higher prices on the resale," Hens said.

He added, "The other piece of the puzzle that they do, is they have such a knowledge of what vehicles are pulling in -- higher values -- that they'll have you buy the vehicle in the first place knowing that's going to drive a higher price on resale. Right now, we put a bid out and we're stuck with the low bidder."

The county is looking at switching out the fleet at the start of 2018.

Fleet arrangement with Enterprise could save county $80K a year

A proposal to switch out the most of the county's current fleet of vehicles to a national vendor to manage and maintain the fleet could save the county as much as $80,000 a year, according to a proposal presented to the Legislature's Public Service Committee on Tuesday.

Enterprise Rent-a-Car provides the same service to several other counties in New York, said Representative Jimmy Adams, and those counties have achieved the anticipated cost savings and seem satisfied with the service.

The program will start with Enterprise taking 47 of the vehicles in the county's fleet now and selling them at an estimated total of $580,000 returned to the county. Enterprise would then replace those 47 vehicles with 47 new vehicles, purchased at the typical discounted government bid rate, and the county would make payments on those vehicles.

Legislature Chairman Ray Cianfrini wanted to know if Enterprise would guarantee that the 47 vehicles would sell for at least $580,000 and Adams said, in a word, no.

"We are very conservative (in our estimates)," Adams said. "We have a remarketing manager who is in our Rochester office. His sole job is to go through, give these values to new clients and current customers and make sure those are values we can live up to because we know at the end of the day, if we don't we're going to be in meetings similar to this and explain why we missed."

County Manager Jay Gsell said doesn't expect any surprises when Enterprise puts the vehicles on the market.

"Based on the current age of our fleet and the condition in which the motor pool maintains those, I don't think we've got any hidden upsets as far as that's concerned, but there is nothing absolute in terms of what the whole 47 will generate in net value," Gsell said.

The other potential problem, Cianfrini said, is what if the partnership doesn't work out and the county wants out of the deal. He thinks the county will be out 47 vehicles and will need to buy 47 vehicles.

Adams said, first, that has never happened with one of these vendor arrangements for a government entity, and second, even if that were the case, the county will be in a "positive equity position" on each vehicle because the government bid price on the vehicles is so low. Over the first year or so of such an agreement, the county would be paying down the principal owed on each vehicle and if Enterprise sold the car at that point, "Enterprise would be writing a check to the county," Adams said.

That positive equity position would make it easier, Adams said, for the county to walk away from the deal if it decided to go that route.

There are also potential cost savings because Enterprise will be responsible for maintenance and mechanical repairs on the vehicles, which could mean the elimination of a mechanic's position from the county's budget. Cianfrini suggested that instead of eliminating a job, perhaps that service could be sold. Gsell said the county has a history of not competing with private enterprise and thought it would be logistically difficult to offer that service to another county. Committee Chairwoman Shelly Stein noted that Tim Hens, county highway superintendent, has said (he wasn't at the meeting) that there is plenty of backfill work that is going undone that could be done if a mechanic was freed up from his current duties.

A state audit found a flaw in how the county was accounting for its fleet expense and this agreement would help resolve that issue, Gsell said, which is one reason why he's recommending the Legislature move on the proposal this budget year instead of waiting until 2018.

Comprehensive Plan Steering Committee to make presentation to Legislature on Sept. 11

Press release:

All members of the public are invited to join for the 17th annual Genesee County Comprehensive Plan Steering Committees presentation to the Legislature. The presentation will be held at 6 p.m. on Monday, Sept. 11, at the Old Court House, 7 Main St., Batavia.

The Comprehensive Plan Steering Committee meets six times throughout the year, taking in feedback from more than 100 individuals from various levels of government, nonprofit agencies, business and industry, and interested citizens regarding the topics: Agriculture and Food Production; Community Wellness; Criminal Justice and Emergency Management; Economic and Workforce Development; Government Administration and Education; Housing Opportunity; Land Use, Environment, and Place-Making; Parks, Arts, Recreation and Culture; Technology and Utilities; and Transportation and Mobility.

The information gathered through this process is then reported to the legislative body to guide them in ongoing decision making and as they develop the next year’s County Budget.

Advance information may be obtained by contacting Derik Kane at the Genesee County Planning Department

County Building 2

3837 W. Main Street Road

Batavia, NY 14020

(585) 815-7901

New support network forming for those in Genesee County who have arthritis

A new support network for adults living with all types of arthritis and rheumatic diseases is launching in Batavia on Sept. 27.

The Arthritis Support Network in Western New York will hold its local debut event from 6 to 8 p.m. at the Richmond Memorial Library, located at 19 Ross St. in the City of Batavia.

It aims to help and support those with arthritis through connection, education and empowerment.

To RSVP or to get more information, contact Jim@Arthritisintrospective.org or go online to arthritisintrospective.org/local

GOW Opioid Task Force goals beginning to take shape

How do rural counties with limited resources combat an issue as multifaceted as heroin and opiate addiction?

Quite simply, they collaborate to find common-sense practices to beat the dragon.

In January, officials, doctors, healthcare providers, and community members from three counties -- Genesee, Orleans and Wyoming -- formed the GOW Opioid Task Force.

Its goal is to not only raise awareness of the growing epidemic but to also find and compile: a list of resources available to addicts and their families; data on the number of overdoses, deaths, and uses of naloxone within each county; and identifying roadblocks to treatment.

During the July meeting, a roadmap of sorts was laid out for the Task Force.

From the time an individual is born, they are, to some degree, rated on performing tasks independently. Doctors gauge a child’s progress: Sits independently. Walks independently. Teachers grade a student’s performance: Works independently. It’s a skill desirable to some employers: Must be able to work independently.

It is a mantra instilled in a person's mind from a very young age: Be an individual. Don’t follow the crowd. Learn to be independent. Yet, there are times, when being independent becomes counterproductive to the needs of a community.

Although each of the GOW counties are afflicted with the same problem – the increase in overdoses and deaths due to heroin and opiates – independently, there are gaps in services and help for both addicts and their families. However, collectively, the Task Force can help fill those gaps.

In an effort to find where each county is lacking and how to get funding for the resources it needs, the Task Force determined three areas to address: community education and action, data compilation and access to care.

Community education and action

Three goals were created to better educate the public:

• Educate students, parents and community about the dangers of heroin and opioid use – Narcan training and education, sharps and medicine disposal sites, and develop materials for distribution;

• Identify resources and local partnerships to help prevent use – pharmacies, law enforcement, recovery services, and mental health service; and

• Develop recommendations for future goals and action steps to prevent use – encourage attendance and participation in Task Force meetings, recovery coaching, peer speakers, and more.

Data

Part of the requirements for applying for State funding is to have the data and statistics to back up the need. However, compiling those numbers becomes a collaborative effort between multiple agencies. Additionally, the task is further hindered by the fact that the Monroe County Medical Examiner’s (ME) Office handles cases from its own and the GOW counties. Subsequently, toxicology reports are often not received back for six months or more.

According to a recent report, the Monroe County Medical Examiner’s Office has performed 1,020 autopsies in 2016. In 2015 it was closer to 900. In 2008 approximately 975 were performed and in 2005 860. The years 2012 and 2013 both showed approximately 880.

The goals of this group are to develop a tool to track data, identify the data each county already has, and perform a gap analysis to identify missing data and create a plan to overcome any barrier.

Access to care

Again, a barrier addicts and family members face is access to care in relative proximity to where they live.

Officials say when an addict is ready to get the help they need to begin the recovery process, there is an immediacy to their need.

One of the goals of this group is to map out the access to care in the Western Region Naturally Occurring Care Network (NOCN).

The NOCNs include the Finger Lakes, Monroe, Southeastern, Southern, and Western regions of New York State.

In addition to finding a place to receive care, the group also identified eight groups of potential entry points for families and individuals in crisis. They include hospital emergency rooms, crisis hot line, primary care physicians, law enforcement, community-based organizations, healthcare homes, community-based groups, and schools and colleges.

Nationwide, every 17 minutes someone dies from an opioid overdose. About two years ago, there were 100 deaths in Erie County. In 2015, it more than doubled. In 2016, that number could reach over 500. That’s about 10 per week. February alone recorded 23 overdose deaths in just one week.

In Wyoming County, between 2010 and 2014 the number of opioid-related emergency department admissions increased 47.6 percent – 42 and 62. The number of opioid-related inpatient hospital admissions rose from 61 to 91 respectively – a 49.2-percent increase.

According to a recent article in The Batavian, there were five deaths in Genesee County that the Monroe County Medical Examiner attributed to the overuse of opiate-related drugs in 2013.

In 2016, 17 deaths with toxicology completed were attributed to drug mixtures that included opiates, with four toxicology reports for last year still pending.

To date in 2017, there are seven deaths where toxicology is still pending.

Of the 17 known OD-related deaths in 2016, only five were attributed to heroin mixed with other drugs, whether prescription drugs and/or over-the-counter medications. (Note: the ME for 2016 was Erie County.)

There were nine deaths caused by a combination of prescription opiates mixed with other drugs.

There was one death caused by "acute and chronic substance abuse."

Of the 18 overdose deaths in 2015, 14 involved prescription opiates used in combination with other drugs and two were caused by heroin used in combination with other drugs.

In 2014, there were 12 drug-induced deaths. Nine of the 12 involved prescription opiates combined with other drugs. Heroin, used singularly or in combination with other drugs, contributed to three deaths.

Between 2010 and 2014 those who were admitted for treatment for any opioid in Western New York was 7,679 in 2010. By 2014, the number of people seeking treatment rose by almost a third – 10,154 – a 32-percent increase.

Across the state, those in treatment for heroin use was 55,900 in 2010; in 2014, the number was 77,647. Deaths across the state due to heroin overdose increased 163 percent (215 in 2008, and 637 in 2013) and opioid overdoses increased 30 percent (763 to 952).

While nearby counties like Erie and Monroe have access to more mental health services and rehabilitation centers due to their populations, Genesee, Orleans and Wyoming counties struggle to find those same services closer to home for their residents.

The next meeting date and time for GOW Opioid Task Force to be determined.

For more information, Kristine Voos at Kristine.Voos@co.genesee.ny.us

Genesee County Fair 4-H Livestock Show results

Submitted photos and press release:

The Genesee County 4-H Office would like to congratulate all of the Genesee County 4-H members who exhibited animals at the 2017 Genesee County Fair. We would also like to thank all of our club leaders, volunteers, family members and friends who volunteered their time; we could not do it without you!

Below are some highlights from the 2017 Genesee County Fair 4-H Livestock Shows. (*See Editor's Note below.)

Photo from 4-H Beef Cattle Show. From left: Becky Kron, Judge Eric Bond, Shianne Foss.

4-H Beef Cattle Show

Senior Showman – Shianne Foss

Junior Showman – Autumn Mathisen

Master Showman – Shianne Foss

Supreme Champion Female – Autumn Mathisen

Reserve Supreme Female – Emily Ehrmentraut

Grand Champion Steer – Shianne Foss

Reserve Champion Steer – Becky Kron

4-H Goat Show

Senior Showman – Melissa Keller

Junior Showman – Cody Ehrmentraut

Novice Showman – Jade Winn

Champion Nigerian Dwarf Doe – Jade Winn

Champion Market Goat – Melissa Keller

Photo from 4-H Sheep Show -- Ben Kron with his Supreme Champion ewe.

Photo from 4-H Sheep Show -- Becky Kron with her Supreme Champion ram.

4-H Sheep Show

Senior Showman – Melissa Keller

Junior Showman – Madelynn Pimm

Novice Showman – Hunter McCabe

Master Showman – Melissa Keller

Supreme Champion Ram – Becky Kron

Supreme Champion Ewe – Ben Kron

4-H Hog Show

Senior Showman – Melissa Keller

Junior Showman – Katelynn Rumsey

Novice Showman – Camden Baris

Master Showman – Melissa Keller

Champion Gilt – Melissa Keller

Champion Non-Sale Market Hog – Melissa Keller

Photo from 4-H Dairy Show. From left: Genesee County Dairy Princess Rebecca Slattery, Maggie Winspear, Mary Sweeney, Judge Shane Schultz, Dairy Princess Runner-up Miah Werth.

4-H Dairy Cattle Show

Senior Showman – Emily Mikel

Intermediate Showman – Colton Slattery

Junior Showman – Hudson Luft

Novice Showman – Justin Deleo

Master Showman – Emily Mikel

Reserve Master Showman – Mary Sweeney

(*EDITOR'S NOTE: Photos for the 4-H Hog Show and the 4-H Goat Show will be published next week along with a press release about auctions.)

Photos: Genesee County Fair opening day

The Genesee County Fair opened Monday at 9 a.m. and will be open through Saturday. There is a $5 admission per carload and the daily schedule is located here.

This year, as always, there are carnival rides, food, farm animals, livestock competitions, music performances and large farm equipment.

Monday is "Emergency Responder Night"; Tuesday is "Senior Citizen Day"; Wednesday is "Children's Day"; Thursday is "Veterans Day"; Friday is "Community Day and Thrill Night"; and Saturday is "Farm Bureau Day and Bring Your Tractor to the Fair Day."

Public health column: 'Be lead safe this renovation season'

From county health officials:

It is officially summer, a popular time for home renovations. Home renovations can be a complicated undertaking and renovating an older home presents its own unique set of challenges. Specifically, homes built before 1978 could contain lead-based paint and other lead sources which pose a health hazard, especially to children.

“The biggest problem with renovations involving lead is the dust that is produced during sanding, cutting, and demolition. Dust can settle on various surfaces and be inhaled into the lungs or ingested through common hand-to-mouth activities,” said Brenden Bedard, director of Community Health Services for Genesee and Orleans counties.

The first step in any home renovation project is to decide if you are going to hire a contractor or if you are going to “Do-it-yourself.” Please note that, in most cases, landlords are required to hire a professional and cannot do the work themselves. In either case, safe work practices need to occur in order to protect you and your family.

Hiring a contractor: When hiring a contractor, ask about their work practices to minimize lead hazards. Also, you should verify that your contractor is certified by the EPA. The EPA’s Lead Renovation, Repair and Painting Rule requires contractors working on buildings built before 1978 to be certified by the EPA, use renovators that are properly trained, and follow safe work practices. Finally, make sure that the details of your renovation are clearly laid out and that everyone involved understands what will be happening during setup, renovation, and cleanup

Do-it-yourselfer: If you are a homeowner undertaking a renovation project yourself, you need to be educated on proper work practices to keep you and your family safe from dangerous lead dust.

Consider hiring a certified lead inspector before you begin your project to determine if your home contains any lead in the work area.

Work safely by removing any furniture, rugs, and other household items before you begin the project which could get covered with dust and use plastic covering to seal off doors and vents to prevent the spread of dust outside of your work area.

Use the correct equipment including certified respirators, HEPA vacuum cleaners, protective clothing, etc. to minimize the risk involved.

When the work is finished, clean-up must be done properly. Use of a vacuum cleaner, with a HEPA filter, wet wiping, and wet mopping to remove any dust and debris from all surfaces is important. It is also important to remember that lead dust may not be visible to the naked eye; just because you can’t see it, doesn’t mean it’s not there! Contractors need to use a cleaning verification card to confirm cleaning was done properly. You can also choose to have a lead-dust test performed. Testing should be done by a lead professional. Contact the National Lead Information Center at 1-800-424-LEAD for more details (If using a contractor, lead-dust testing should be discussed before the project begins.).

If done properly, home renovation should be a safe process for you and your children. Of course, don’t forget about your pets! Pets are just as susceptible to the effects of lead and should be considered when planning your project. For more information about home renovation involving lead and for a more complete list of safe work practices, visit the EPA website at https://www.epa.gov/lead. Your local health department can also provide educational materials and advice with regards to lead.

For information about health department services contact:

- Genesee County Health Department at: 344-2580 ext. 5555 or visit its website at www.co.genesee.ny.us/departments/health/index.html.

- Orleans County Health Department at: 589-3278 or check out its website at: www.orleansny.com/publichealth.

- Wyoming County Health Department at: 786-8890 or visit its website at www.wyomingco.net/health/main.html.

'Torrential rains' expected in Southern Genesee County within the hour

A Special Weather Statement was issued a few minutes ago by the National Weather Service stating: "An area of strong thunderstorms will bring torrential rains to Northern Wyoming and Southern Genesee counties.

"Strong thunderstorms were clustered near Attica, or eight miles south of Batavia, moving east at 15 mph.

"These storms will bring very heavy rainfall to Attica and nearby locations with more than an inch of rain possible in an hour or less. Locations impacted include... Darien Lakes State Park, Le Roy, Bennington, Attica, Pavilion, Stafford, Covington, Alexander, Wyoming and East Bethany. This includes Interstate 90 near exit 47. Torrential rainfall is also occurring with this storm, and may cause localized flooding. Do not drive your vehicle through flooded roadways."

These conditions are expected until 2 p.m.

Hazardous weather outlook: 'Lake effect rains' could hit Genesee County tonight

A hazardous weather outlook was issued today for portions of Western New York, including Genesee County, by the National Weather Service.

It says "An anomalously cold upper level trough crossing the region combined with warm lake temperatures will result in the development of lake effect rains tonight and into Tuesday, potentially resulting in localized flooding, particularly across low-lying flood-prone areas."

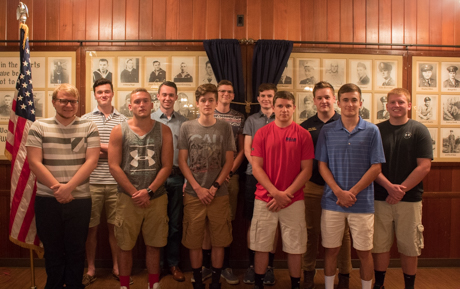

Meet and Greet held before Boys State departure

The Genesee County representatives for the American Legion Boys State of New York met on Thursday night in Le Roy, before they depart on June 25.

The American Legion Boys State is a weeklong program that immerses high school youth in citizenship and leadership training. While at Boys State, they learn the practical aspects of government in New York and participate in physical fitness, teamwork and other activities under the guidance of counselors and Marines.

This year, Boys State will be held at SUNY Morrisville.

Bryce Bordonaro, Ryan Driscoll and Thomas Mellon are representing Le Roy; Jacob Brower is representing Waterport; Ethan Fischer, John Kindig, Nathan Loria and Joseph Marchese are representing Batavia; John Igoe is representing Oakfield; Nathan Knickerbocker is representing Byron; and Tyler Wood is representing Corfu.

(Photos by Maria Pericozzi.)

GC Dairy Princess crowns 2017 Dairy Baby

In conjunction with June Dairy Month, the Genesee County Dairy Princess honored the first baby born in Genesee County.

Isaac, a baby boy, was born to Hannah Gimlin and Matthew Guiste at 6:13 p.m. on Thursday, June 1, at United Memorial Medical Center. Isaac weighed 7lbs. 8oz., measured 19 ¾ inches long and was delivered by Patricia Beverly, CNM.

The Genesee County Dairy Princess, Rebecca Slattery, presented the family with a gift basket of items including dairy products coupons, infant toys and a number of other items.

June is National Dairy Month, which honors traditions and celebrates the contributions of the dairy industry by promoting nutrient-rich dairy foods.

Hawley introduces bill to bolster local government amidst Cuomo's 'shared services threat'

Press release:

Assemblyman Steve Hawley (R,C,I-Batavia) announced Wednesday that he has introduced legislation to revamp the Assistance and Incentives to Municipalities (AIM) formula, a large pool of state funding to help local governments undergo projects and conduct local operations of the government.

Currently, about 90 percent of this funding goes to cities and Gov. Cuomo is requiring local governments to devise consolidations plans to receive the funding as part of this year’s budget.

“Unfunded mandates like Medicaid handed down by downstate politicians continue to strangle the budgets of our local governments and are the driving force behind high property taxes,” Hawley said.

“This legislation would level the playing field for many small municipalities and help them receive their fair share of state funding. The AIM formula hasn’t been revised in a number of years and a more equitable formula would help our town, village and county governments reduce taxes and undergo projects like road and bridge repair. I am calling on Assembly leadership to bring this bill to the floor for a vote before be adjourn for the summer next month.”

GCOM adds Nursing Home Ministry

Recently the Genesee County Outreach Ministry (GCOM) has offered a weekly Bible Study at the Premier Nursing Home and Rehabilitation Facility, formerly known as the Genesee County Nursing Home. Residents are encouraged to choose topics or Scripture passages. Examples include:

- The Lord's Prayer

- The Beatitudes

- Faith

- The Holy Spirit

- Spiritual Gifts

- The Book of Romans

- The Book of First John

We average between 8-12 residents weekly. With many in wheelchairs, an aide is always present. We have had great support from the staff!

If you’d like to help us to build this ministry, please contact us!

- David Twichell (716) 704-9623 and John Yerger, Jr. (585) 880-5215

County to begin process of forming shared services committee in answer to governor's mandate

The latest mandate on county governments isn't all bad, the way at least one local legislator and County Manager Jay Gsell see it.

It's not a bad thing, they say, to look at opportunities to institute new shared services agreements among local agencies.

The difficulty may come in finding where those cost savings can be realized when the county has already consolidated many operations with other government agencies.

To meet Gov. Andrew Cuomo's requirement, the county must convene a committee of people representing the other government agencies in the county -- the city, schools, towns, villages -- and explore options for consolidation of agencies or shared services among agencies. The committee's work will result in a report approved by the County Legislature and delivered to the governor's office within two years.

There's no requirement that any of the ideas generated by the process actually be implemented.

That's certainly the governor's goal, Gsell said, but right now he just wants to push along the process of local agencies talking along these lines.

"In the initial year this is more (about) dialogue and discussion, (to) gauge whether there is interest in doing some of the things we’ve talked about," Gsell said.

Legislator Andrew Young said he thinks it's a good idea to have these discussions anyway.

"It helps get the discussion started," Young said during yesterday's Ways and Means Committee meeting. "I’m not saying it’s going to be easy because when mandates come down on us from the almighty it bothers us, but we should try to embrace this.”

Going back to the 1990s, the county has been involved in finding opportunities for shared services, Gsell said, starting with the Highway Department and its arrangement with town highway departments. The county has also been involved in creating shared services for emergency dispatch, consolidating the youth bureaus, including combining with Orleans County, and the health departments between Genesee and Orleans counties.

None of that will help the county with this report, though. The participating local governments must look for new opportunities.

Those might include a consolidated assessors office (right now, three assessors are shared among multiple agencies), or the creation of a centralized procurement office, consolidating code enforcement and zoning.

Right now, those are just examples and all come with their own challenges. Identifying those challenges will be part of the reporting process for the governor.

There may be ideas for consolidation or shared services that require the approval of legislators in Albany, and big projects, such as a shared jail between Genesee and Orleans counties, come with an array of challenges and potential legal complications.

The fact, though, that the county has completed so many shared services projects bodes well for officials to find more opportunities to cooperate, Gsell said.

"All of that stuff is behind us, but the fact that we’ve done this is an indication to me that we can do more," Gsell said. "We just have to put it on the table and get people to put on the table what are their issues, what are their constraints, and how do we get past them."

Health Department report shows sharp increase in opioid-related deaths locally

There has been a sharp increase locally in overdose-related deaths, usually involving a combination of drugs including opiates, over the past four years, according to a report prepared by the Genesee County Health Department.

The rise is alarming, said Director Paul Pettit, and emphasizes the need for the work of a three-county task force that has come together to find ways to address the drug-use epidemic that has hit the region.

It's not just the number of deaths that have increased, Pettit said. There are more drug-related arrests, more drug-related visits to emergency rooms, and first responders are using the drug Narcan more frequently to help revive opiate overdose victims.

In 2013, there were five deaths in Genesee County that the Monroe County Medical Examiner attributed to the overuse of opiate-related drugs.

There were 18 in 2015.

In 2016, 17 deaths with toxicology completed were attributed to drug mixtures that included opiates, with four toxicology reports for last year still pending.

To date in 2017, there are seven deaths where toxicology is still pending.

"That's a pretty significant increase over the past four years," Pettit said. "It's indicative of a problem going on out there."

Of the 17 known OD-related deaths in 2016, only five were attributed to heroin mixed with other drugs, whether prescription drugs and/or over-the-counter medications. (Note: the ME for 2016 was Erie County.)

There were nine deaths caused by a combination of prescription opiates mixed with other drugs.

There was one death caused by "acute and chronic substance abuse."

It's possible that some of the heroin deaths linked to other substances might mean the heroin was laced with fentanyl or another drug.

Fentanyl is frequently linked to overdoses because users never know how much fentanyl has been added to their heroin and fentanyl is more powerful than heroin.

A 30-gram dose of heroin will kill an average size male, but only three milligrams of fentanyl can be fatal.

Of the 18 overdose deaths in 2015, 14 involved prescription opiates used in combination with other drugs and two were caused by heroin used in combination with other drugs.

In 2014, there were 12 drug-induced deaths. Nine of the 12 involved prescription opiates combined with other drugs. Heroin, used singularly or in combination with other drugs, contributed to three deaths.

There were no heroin-related deaths in 2013, but there were five opiate-related deaths involving prescription medications.

The stats do not include Genesee County residents who died in other jurisdictions, but it does include non-county residents who died here.

The Health Department is still in the process of compiling statistics prior to 2013.

Pettit said officials would like to get much closer to real-time statistics for drug-related deaths. When seven people in Erie County died within a 24-hour period last week, officials there were able to know almost immediately the cause of death was heroin laced with another substance.

For Genesee, Wyoming and Orleans counties, officials sometimes wait months for toxicology reports from Monroe County.

One goal, Pettit said, is for the counties to come together and work with the medical examiner offices to get more timely reports, at least within a month of the deaths.

Of the some 500 deaths in the county annually, only about 50 resulted in a request for a toxicology report.

"We want to hone our data collection, look at trends on how things play out in the community," Pettit said.

The stats will help inform community-wide responses.

The Genesee, Orleans & Wyoming Opioid Task Force has held one meeting and will be meeting again from 10 to 11:30 a.m., Wednesday April 19, at Genesee Community College, Room T102.

The task force is comprised of health officials, addiction specialists, law enforcement personnel, church leaders, other service providers, former drug addicts and the family members of addicts. About 75 people are participating from the three counties.

"It's great to see the community coming together on this issue and show a desire to have a positive impact to help those folks in our community who are struggling," Pettit said.

Perry woman charged after giving false details of an accident

The Genesee County Sheriff’s Office filed charges Feb. 16 against Nicole K. Sullivan in relation to a one-car accident that occurred during the early morning hours of June 10.

Sullivan, 31, of Perry, is charged with: falsely reporting an incident in the third degree; unlicensed operator of a motor vehicle; aggravated unlicensed operation of a motor vehicle in the third degree; operation of an unregistered motor vehicle; failure to notify the Department of Motor Vehicles of change in address; no seat belt; and driving left of pavement markings.

On June 10, at approximately 2:25 a.m., an accident on Fargo Road, Stafford, was reported. When deputies arrived on the scene, they say they found a male, later identified as Zachery W. Schwartz, 20, unresponsive in the vehicle and a female, Sullivan, on the front porch at a nearby home.

At the time, Sullivan told officers that there was a third occupant, who was driving the car, and fled the scene, traveling north on Fargo Road.

Schwartz was flown via Mercy Flight 5 to Strong Memorial Hospital, Rochester, for extensive head injuries. Sullivan was taken via Mercy ambulance to Strong for head and leg injuries.

Fire personnel conducted a thorough search on foot of the surrounding areas using FLIR Technology (thermal imaging) in an attempt to locate the unknown driver involved in the crash. The New York State Police assisted by maintaining a roving perimeter of the area. Area hospitals were also notified to call the Genesee County Sheriff’s Office if they received any potential car accident patients.

Approximately three hours after the accident was reported, Sullivan admitted to police that she and Schwartz were the only occupants in the vehicle and she was the driver.

The charges stem from the allegation that Sullivan was in fact the driver of the car at the time of the collision and she gave false information concerning the details of the incident. It is further alleged that there was not an unknown driver of the car who fled the scene as originally reported by Sullivan.

Assisting at the scene of the accident included Stafford, Batavia, and Le Roy fire departments, Genesee County Emergency Management, and Mercy medics.

For original post, click here.