Consultants suggest a county advisory board and additional housing for all types of needs as part of study

Image from Urban Partners presentation

A county advisory board with plenty of collaboration and housing of all types for all income levels should be on the horizon for Genesee County if municipal leaders want to get ahead of what’s coming in the next 20 years, consultants from Urban Partners say.

That seemed to be the thrust of the summary recommendations from a housing study by Christopher Lankenau and Isaac Kwon presented this week as part of a five-phase needs assessment that included public surveys, current and future business developments, housing stock, occupancy rates, demographics and trends.

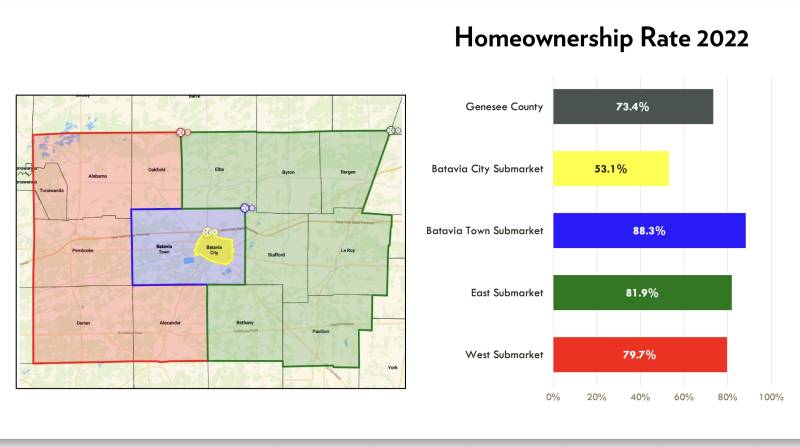

Speaking of trends, renter-occupied homes in Genesee County have increased over the past decade. However, while the demand for rentals has increased, availability has become “very, very low,” Lankenau said, with a total of 6,497 rentals in Genesee County and 3,456 in the city of Batavia.

While the study found a need for housing to accommodate people in all categories—from low-income to market-rate levels—Lankenau said he would recommend an apartment complex in the city of Batavia for very low—to low-income renters, but with a caveat. The Batavian asked him about it, considering Ellicott Station just happens to be sitting half-baked and idle on the city’s south side.

“I know there's often criticism concentrating low-income housing in certain areas, but it often happens for a reason, too, because of just the availability of amenities. Yes, so I think yes would be an answer. Still, it would be about a fair distribution of low-income housing to ensure that people in Le Roy or other more concentrated parts of the county also have that opportunity, and they don't have to move to Batavia, for example,” he said. “I don't know if that directly answers your question, but I think yes, Batavia could afford some more … and would be a good location for additional low-income housing on a smaller scale, not some of the more recent stuff that has been built, over 20 to 40 units, the days of the really large tax credit projects, so I think those kinds of smaller projects that could integrate pretty nicely into existing communities.”

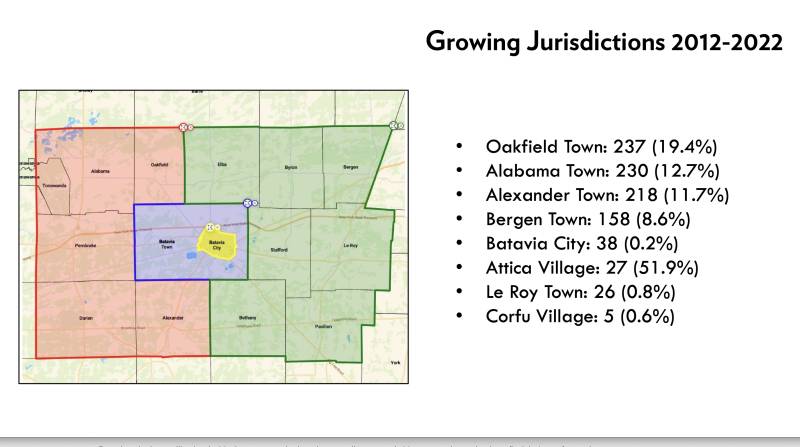

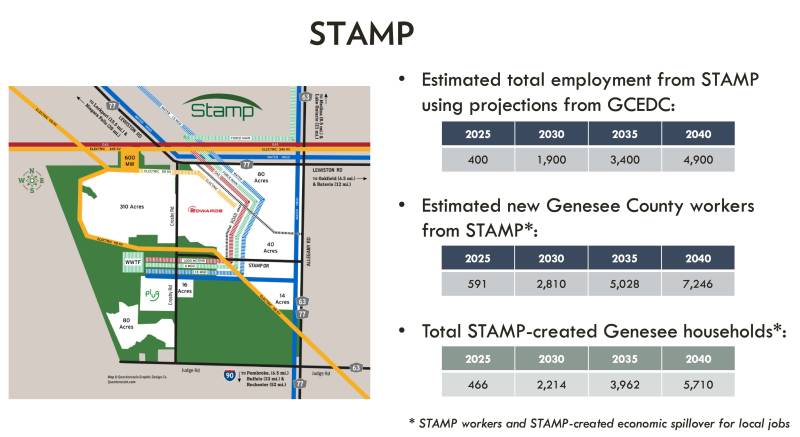

Despite declining population here, the future planned development and expansion of STAMP is anticipated to be “a huge game-changer,” he said. STAMP is to generate a significant housing need for workers while a growing senior population will require its own supply of new housing stock, he said.

“What is the county going to need to provide?” he said. “STAMP is anticipated to generate a significant need for workers while a growing senior population is going to be a significant need.”

How much do you need? Estimates put the number to 5,028 workers by 2035 and upwards of more than 7,200 workers created by STAMP — the 1,250-acre Science, Technology & Advanced Manufacturing Park —d as of 2040. The projected related household change is an additional 5,710 due to the STAMP employment surge alone, the consultants said.

The study found that the anticipated growth of new residents in the county translates to a need for 308 new units per year for the next 16 years. That totals 6,164 new supply — owner-occupied and rental housing — to accommodate a senior base of folks 65 years and older, as well as the effects of the STAMP development in the western part of the county.

Recommendations include increasing the housing variety in the county to offer more attainable options for those populations that will be seeking a place to call home, facilitating the expansion of new housing development in the county’s priority development areas to both stimulate and prepare for growth associate with STAMP and other economic development; expand housing options for the growing senior population; and stabilize and rehabilitate the county’s aging housing stock.

A suggested way to implement this is to secure community support for a diversified housing stock by:

- Creating a countywide housing working group.

- Sharing the housing study broadly throughout the county.

- Proving evidence-based information to elected officials, municipal leaders and planning/zoning boards.

- Support municipalities in partnership with the pro-housing community program.

- Continuing to encourage redevelopment and infill projects in the city and villages.

- Continuing to encourage new residential development in priority development areas.

“So diversifying the housing choices. The first strategy, we think, is basically getting support for a more diversifying housing stock. You know, most people are used to single-family detached homes. That's what they see them most on larger lots. People think density is not necessarily a great thing, but I think that's we think that’s what the county really needs,” Kwon said. “More people are looking for that type of thing, market over less maintenance. For less maintenance, less size, closer to amenity. That's what we mean by diversified housing stock.

“We're suggesting several action steps for that, including a housing working group consisting of developers and a landlord basically, kind of around a basis, like putting our heads together and discussing what's missing. What are some challenges? How do we overcome those challenges?” he said. “I think it's a good place to start. Just start talking about this using the study.”

Another way to diversify housing choices is to accommodate all life stages, the consultatnts said, by reducing barriers for first-time home buyers. This could be done by developing or expanding programs/incentives to assist potential homebuyers and examine the feasibility of establishing employer-assisted housing programs.

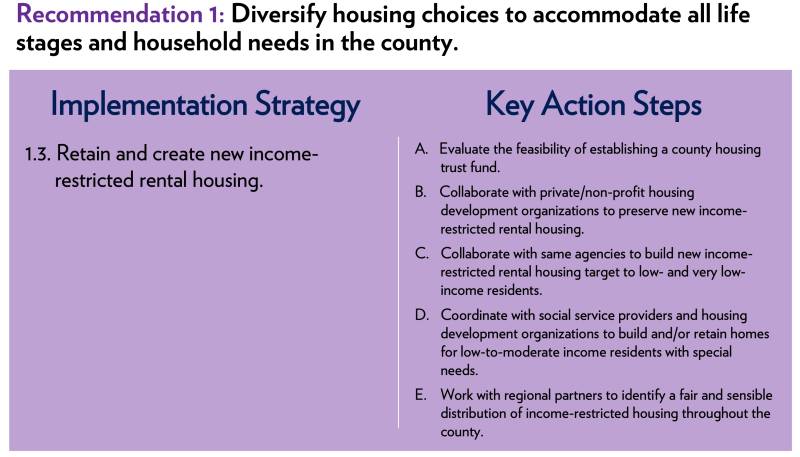

The consultants also suggested to retain and create new income-restricted rental housing.

Key action steps toward this goal include to:

- Evaluate the feasibility of establishing a county housing trust fund and collaborate with private/nonprofit housing development organizations to preserve new income-restricted rental housing;

- Collaborate with the same agencies to build new income-restricted rental housing targets to low- and very low-income residents. Coordinate with social service providers and housing development organizations to build and/or retain homes for low-to-moderate-income residents with special needs; and

- Work with regional partners to identify a fair and sensible distribution of income-restricted housing throughout the county.

Other steps they suggested are to create a countywide housing advisory board consisting of elected officials and/or representatives from each municipality to identify and address specific housing challenges, identify key housing initiatives and pursue housing opportunities, and coordinate with municipalities to identify grants for infrastructure improvements that will assist developers with financing new housing projects.

They coined it a “housing czar” of sorts who would deal with approvals, landlords, and developers. Each municipality would also ensure that developments comply with the comprehensive plan, and these plans “fall in line with the zoning, emissions and goals of the town” to incorporate growth, Kwon said.

“And they’re aware of it and complies with the plan, the zoning … where you offer them some concessions, whether it’s tax or density, that kind of thing, just exploring that stage before things get too crazy to decide,” he said. “And then, of course making sure the infrastructure can absorb this growth.”

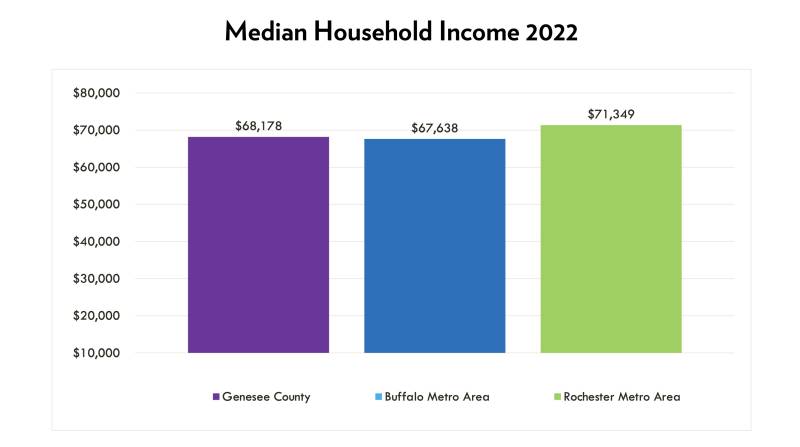

Not that they want to discourage growth: “We need to build more houses,” he said. “It’s making sure that developers build more homes for the workforce that’s coming in, and that can be a variety of homes. The employees moving in who may want a large, higher-end home, but you’re probably going to have, for the most part, a pretty middle-class workforce that is going to afford to have it be built.”

They also want to incentivize developers and home builders to construct more market-rate for-sale housing, including smaller homes targeted to the workforce sector, and promote the development of mixed-use and multi-family apartments, townhomes, and condominiums in Priority Development Areas with existing infrastructure near transportation and services.

Because many seniors seem to want to stay in their own homes versus going to a nursing or assisted living home situation, action steps toward that end include initiating a senior home modification program that offers grants, low-interest loans, and/or volunteer labor to help mobility-challenged seniors live safely in their current homes, plus continued promotion of the county’s Handyman Program to assist low-income seniors with small household repairs, they said.

These action steps for seniors would help them to remain independent for longer time periods by making their current living situations safer with modifications such as ramps.

At the other end of the spectrum, they also recommended supporting general home renovations for older houses — including incentives for the demolition and replacement of distressed homes — and establishing a county land bank to address any problems of vacant, abandoned, derelict, contaminated or tax delinquent property and encourage the repair and rehab of vacant rental units and other vacant spaces to increase the supply of critically needed apartments for low-and moderate-income renters.

For the full slide presentation, go HERE.