SEC complaint against Collins reveals alleged insider trading saved sellers $768,600

Here is a summary of the civil complaint against Rep. Chris Collins and his co-defendants on charges of insider trading. Indented paragraphs are direct quotes from the document. Paragraphs that are not indented are summaries, sometimes containing direct quotes. To read the full complaint, click here (pdf)

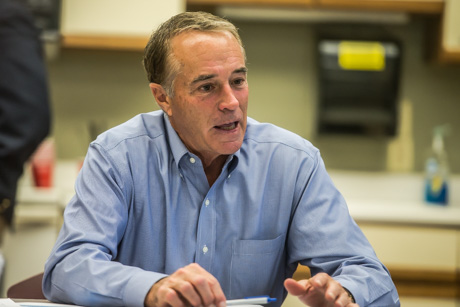

On Thursday, June 22, 2017, Christopher Collins, then a member of the board of directors of Innate Immunotherapeutics, Ltd. (“Innate”) and a U.S. Congressman representing the 27th Congressional District of New York, learned material, nonpublic information about clinical trial results for a drug being developed by Innate. That evening, Innate’s CEO emailed Christopher Collins and other members of Innate’s board to report “extremely bad news” that the trial results “pretty clearly indicate[d] ‘clinical failure.’ ”

Christopher Collins responded to the email and then approximately 15 seconds later began attempting to reach his son, Cameron Collins. After exchanging several missed calls, Christopher Collins and Cameron Collins connected and spoke for six minutes. Over the next two trading days, between the opening of the market on Friday, June 23, and the close of the market on Monday, June 26, and while the clinical trial results were still nonpublic, Cameron Collins sold a total of nearly 1.4 million Innate shares based on material, nonpublic information he received from Christopher Collins. Cameron and Christopher Collins spoke by telephone at least nine times during that same time period.

Camaron Collins then allegedly spoke with four individuals, including Stephen Zarsky, who allegedly called two other individuals.

Allegedly, within minutes of hearing from Camaron Collins and his girlfriend, his girlfriend's mother sold her shares of Innate.

Both Camaron Collins and Stephen Zarsky allegedly placed orders the next morning to sell Innate shares.

Later that day, Stephen Zarksy's brother allegedly placed an order to sell his shares of Innate.

Finally, on the morning of Monday, June 26, Cameron Collins tipped a friend who had previously bought Innate shares on his recommendation. Five minutes later, Cameron Collins’s friend placed an order to sell all of his Innate shares.

On the evening of Monday, June 26, 2017, Innate announced the negative results of the drug trial to the public. On the next trading day, Innate’s share price plummeted over 90 percent to $0.0351 from the previous day’s close of $0.45.

In the four days prior to the June 26 announcement, the alleged co-conspirators sold 1.78 million Innate shares. Additionally, Zarsky's contacts allegedly sold another 25,000 shares.

Collectively, the group allegedly avoided losses of $768,600.

As of June 22, 2017, his son Cameron Collins owned over 5.2 million shares of Innate, most of which Christopher Collins had purchased for him.

In early June 2017, Innate informed its board of directors that they would not be permitted to trade Innate securities between June 5 and July 11, 2017, because results of the clinical trial would be released imminently. This blackout period was later modified to allow board members and other insiders to trade 24 hours after the trial results were announced publicly.

Based on seemingly positive news related to the drug Innate was developing in the spring of 2017, "On June 15, 2017, Cameron Collins opened a new brokerage account and used funds from his 401(K) account to purchase 16,508 additional shares."

Likewise, five days later, Cameron Collins’s girlfriend invested in Innate for the first time on June 20, 2017, buying 40,464 shares in a brokerage account that she had opened the previous day.

The indictment quotes text messages from the mother of Camaron Collins girlfriend that indicate Chris Collins was providing information about Innate to her and her husband in the fall of 2016.

On September 9, 2016, Cameron Collins’s girlfriend’s father, Stephen Zarsky, purchased 200,000 shares of Innate. Her mother purchased 50,000 shares the next business day. Stephen Zarsky made additional subsequent purchases. He and his wife purchased a total of 353,005 shares of Innate prior to the relevant trading.

At approximately 6:55 p.m ET, Innate’s CEO emailed the board of directors, stating that he had “extremely bad news to report” and that the results “pretty clearly indicate ‘clinical failure.’ ” He also reported that the consultants “cut and diced the data multiple times/ways to see if there were some meaningful positives, [but] could not find any.” This information was material and nonpublic.

Christopher Collins received the CEO’s email while attending an official event on the South Lawn of the White House. At approximately 7:10 p.m. ET, while still at the event, Christopher Collins responded to the email, “Wow. Makes no sense. How are these results even possible???”

At that point, Chris Collins tried repeatedly to contact his son. The indictment then goes on for several paragraphs detailing the activities mentioned above regarding communications and trading of the stock by the alleged conspirators.

Unlike the other tippees, because of his large position in Innate, Cameron Collins could not sell all of his Innate shares at once without potentially causing a negative impact on the share price. Throughout Friday, June 23 and Monday, June 26, 2017, the two trading days before Innate publicly announced the bad results of the MIS416 clinical trial, Cameron Collins entered at least 58 orders to sell blocks of Innate shares he owned. His trading pattern is consistent with an effort to sell shares quickly while minimizing impact on the share price.

During that trading period, Cameron Collins and Chris Collins allegedly spoke multiple times. Cameron Collins allegedly placed multiple sell orders, sometimes attempting to set a limit price (the sell order won't go through unless the buyer is willing to pay that price or higher) when the limit orders didn't sell, he would place a sell order at "any price," according to the indictment.

The sales by Cameron Collins, his girlfriend, and her parents, including Stephen Zarsky, made up more than 53 percent of the stock’s trading volume that day and exceeded Innate’s 15-day average trading volume by more than 1,454 percent. Innate shares closed at $0.54 per share on June 23, an increase of $0.02 over the prior day’s close.

The next day, Cameron Collins allegedly attempted to place 36 sell orders. In 33 cases, there were willing buyers. He moved 775,000 shares of Innate stock.

In May, shares of Innate owned by Christopher Collins and Cameron Collins were held in an Australian brokerage. Chris Collins initiated the paperwork to transfer the shares to a U.S. brokerage, including opening an account in his daughter's name. The transfer was completed for Cameron Collins on June 9. However, there were apparently errors in the forms for Chris Collins and his daughter. "Thus, at the time that Christopher Collins learned the results of the MIS416 clinical trial on June 22, neither he nor his daughter was able to sell Innate shares in the U.S."

After news reached a reporter June 26 of the failed clinical trial, the reporter called a Collins staff member. Chris Collins then called his son. His son then executed a trade in Australia to sell all of his remaining Australian shares, a total of 3,825,000.

On June 29, 2017, the local newspaper published an article entitled, “Collins’ office says family, chief of staff held onto stock as it sank.” The article contained a statement issued by Christopher Collins’s office worded to dispel any suspicion of insider trading by the Collins family: “Neither Chris Collins [nor his daughter] . . . have sold shares prior, during, or after Innate’s recent stock halt . . . Cameron Collins has liquidated all of his shares after the stock halt was lifted, suffering a substantial financial loss.”

The statement by Christopher Collins’s office omitted the fact that Cameron Collins sold almost 1.4 million Innate shares on the OTC Pink market during Innate’s ASX trading halt, prior to the public announcement of the bad drug trial results, avoiding losses of approximately $570,900. Similarly, it did not disclose that Christopher Collins and his daughter could not sell their Innate shares at that time because their efforts to transfer them to a U.S. brokerage account prior to the announcement of the results of the MIS416 clinical trial had failed.

A portion of the relief sought by prosecutors includes:

Ordering Defendants to disgorge, with prejudgment interest, all illicit trading profits, avoided losses, or other ill-gotten gains received by any person or entity as a result of the actions alleged herein;

Ordering that Defendant Christopher Collins be prohibited from acting as an officer or director of any issuer that has a class of securities registered pursuant to Section 12 of the Exchange Act [15 U.S.C. § 78l] or that is required to file reports pursuant to Section 15(d) of the Exchange Act [15 U.S.C. § 78o(d)];

CORRECTION: Earlier we referred to the document used in this story as a "criminal complaint." The document in possession of The Batavian at the time this story was written was actually from the Security and Exchange Commission and is a civil complaint. There is also a federal indictment that The Batavian had not yet obtained when this story was written.