Genesee County has an oversupply of owner-occupied housing for the extremely low-income people and not enough for market-rate renters, according to a housing study released yesterday.

There's also a shortage -- to the point of being essentially nonexistent -- of single-family, owner-occupied housing for households with incomes of $100,000 to $150,000.

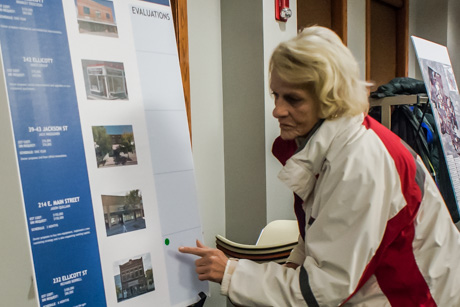

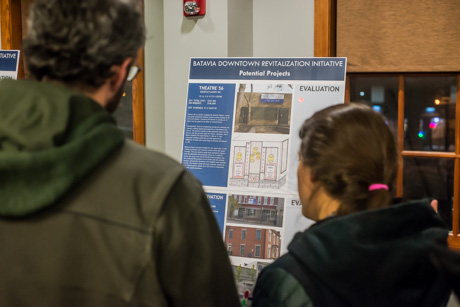

Ed Flynn, a consultant with LaBella Associates, and 24-year resident of Batavia, presented the findings of the county-commissioned housing needs assessment to a gathering of local officials and residents last night at the Old Courthouse.

Other problems facing the county are a slowly declining population and an aging population.

"The demographics and the economics are changing," Flynn said. "The community must recognize that the type of community that Batavia or Genesee County was 10 years ago has completely changed. The type of households have completely changed and we have to recognize and acknowledge that economic development does matter. So in order to avoid the current projections where there is continual population decline you really need to create jobs."

The flip side to shortages in housing is there is demand.

There is demand for middle-income, owner-occupied, single-family housing. There is demand for smaller-unit, smaller-lot, single-family housing in the city. There is demand for market-rate rental properties.

And what people say they want in their housing of the future is housing that is ADA-accessible, with sidewalks and trails and access to alternate forms of transportation and connected to amenities and services.

"Based on the survey, we got a lot of feedback," Flynn said. "People said, 'we want more than just a house. We want a community.'

"So let's look at some small lots, areas of compact development patterns where you can walk and where there are landscaping and smaller houses. Let's look at some downtown areas or some compact development where you can do some of these high-end houses or a mixed-income housing in the downtown areas or some strategic areas in other villages and towns."

As evidence of the demand for market-rate rentals, Flynn pointed to the new apartments that have been added to the downtown housing stock over the past few years. In each case, these apartments were snapped up immediately at rates of $1,000 to $1,500 a month.

Flynn said it will be interesting to see if that trend continues with the four new apartments in the former Newberry's building go on the market, but based on the survey data, it appears the demand for that kind of housing is still present in the City of Batavia.

According to the data gathered for the report, there are 2,070 households in the county with upper-level incomes and only 889 rental units suitable to that market.

There may be additional opportunities to rehabilitate other existing structures and housing units that meet market demands but with more than 80 percent of the housing in the county more than 50 years old, there is growing demand for new housing.

The problem in attracting new housing development, however, is the low cost of current housing.

The median single-family housing price has dropped from $115,192 in 2000 to $107,000 in 2015. Rental rates have risen only slightly, from $715 in 2000 to $724 in 2015.

The average cost of an existing housing unit is $83 per square foot. The average cost of new construction is $175 per square foot. That means an existing 1,650-square-foot house might sell for $136,950 but it would cost $288,750 (excluding developer profit and permitting fees) to build a new 1,650-square-foot house.

Without government-backed incentives, Flynn said, it will be difficult to attract developers to Genesee County to build new housing.

Those trends holding housing prices down also means owners are less likely to upgrade and improve their existing properties, whether owner-occupied or rental.

"If you have a house and you know the value is not going to change, you are probably not going to do as many updates," Flynn said.

Among the recommendations in the report is creating a countywide program to provide incentives for owners of single-family homes to rehabilitate and upgrade those units.

Over the next 20 years, there will be a demand for 4,804 additional housing units in Genesee County, according to the report.

There will be a need for 2,858 single-family units, with 1,699 on standard lots and 1,159 on small lots.

Nearly 80 percent of the 4,804 new units will need to be rental properties, with 1,138 of those being part of multi-family complexes.

While most people, the survey found, want to live in single-family homes -- 78 percent -- there increasing interest in multi-family or small units, such as patio homes, townhouses, senior living apartments, duplexes, and apartments (89 percent).

Forty-two of the respondents said they want to move into smaller living units and 33 percent said they want lower cost housing in the future.

There is also a strong need for housing the meets the needs of people with disabilities, with 13.4 percent of the population having some sort of disability. With an aging population, that number will grow. Nearly 20 percent of the people in poverty are disabled.

For the poor, housing is often substandard or too expensive for their income levels. More than 6,800 households in the county are living with housing with problems. Examples include plumbing problems or substandard kitchen facilities. More than 20 percent of renters are paying more than one third of their income in rent and more than 20 percent are paying more than 50 percent of their income in rent.

For owner-occupied homes, there is an oversupply of extreme/very low-income units, with only 885 households qualifying at that income level and 3,355 such units in the county.

Meanwhile, there are 15,050 households who could afford market-rate and higher owner-occupied properties but only 8,871 such units exist.

There is also demand in the low-income range -- between extremely low income and middle income -- for suitable housing.

For renters at the very low-income spectrum, there are 1,600 such households and only 565 such units available.

Meanwhile, there is an oversupply of low-income and middle-income rental units.

"We need to consider economic development," Flynn said. "And I'm not just saying that because I like the folks at the EDC (county Economic Development Center) or other economic professionals, because if you create jobs and you create wealth you're going to create demand for housing."

Click here (PDF) for the written report.