Batavia's ethnic roots reflected in bakeries that used to dot the city

Over the years bakeries found homes on the corners of many Batavia streets, especially Ellicott Street. There was nothing like the aroma of freshly baked bread wafting through the store. It was a smell of comfort.

One of the earliest bakers was Louis Uebele, who came from Germany and settled in Batavia in 1900. He was responsible for baking all of the bread that was served at the newly built New York State School for the Blind. His building was on the corner of Main and Center Street. That location had several owners over the years and was known at various times as Henning’s, Williams’ Bakery, and Andrews’ Bakery. There were other bakers who baked out of their homes for their neighbors.

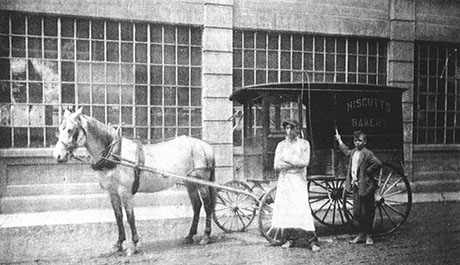

In 1905 the Hiscutt Brothers, Arthur and Robert, started a small business at 240 Ellicott St. The business expanded and the brothers bought a lot on Center Street south of the Masonic Temple. In 1921 the Hiscutts bought the lot next door to be used as a garage and shipping room. They delivered baked goods via horse and wagon even though automobiles were a new commodity. The Hiscutt Brothers ran a very successful business for more than 25 years. By 1932 the completion of chain store bakeries was cutting into their profits. In 1937 the Genesee Trust Company took ownership of the business. It was then sold to R. Walter Riehlman of Tully, NY. He changed the name to The Table Top Bakery.

Table Top Bakery renovated the former Hiscutts’ building. Two delivery routes were established and the cream and orange International trucks could be seen on the roads. Eventually, Table Top Bakery was servicing nearly all of Genesee County. Two 300-loaf ovens were in use 24 hours a day supplying bread and other products to meet the needs of their customers. A retail shop was maintained at the plant for the convenience of local shoppers who opted out of the delivery service.

Quintalino and Lucia (Zinni) Prospero had a bakery on Ellicott Street. Mr. Prospero was a skilled baker who emigrated from Abruzzo, Italy, and ran the Prospero Bakery at 421 Ellicott Street in the early 20th century. Mr. Prospero trained Mr. Colangelo who later opened a bakery on Ellicott and Mr. Saracini who opened a bakery on Liberty. Unfortunately, there was a fire at Prospero's bakery in the mid-1930s that resulted in the closing of the bakery. Prospero's Bakery was the original Italian bakery in Batavia. It was remembered as the bakery that sold day-old bread for one cent to the poorer families.

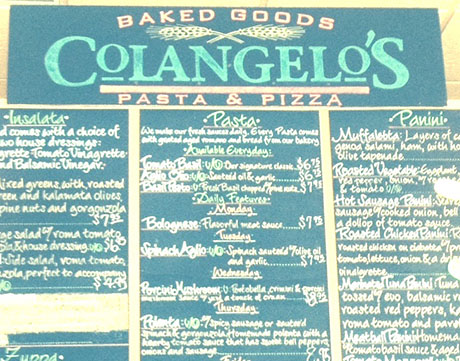

Colangelo’s Bakery was located on Ellicott Street and was commonly known as the Ellicott Bakery. It was originally called Alexander Colangelo’s Bakery. In the ‘30s there was a second Colangelo’s run by Nicholas Colangelo on 119 Liberty Street. Nicholas Colangelo’s bakery closed in 1937 and Alexander Colangelo’s bakery was open until 1973.

Casmir Stomper came to Batavia from Poland in 1925. He became familiar with the locals when, with a basket of bread over his arm, he went door to door making deliveries in the neighborhood. In 1930 he opened a Polish bakery at 208 Swan Street. He later moved his bakery to 400 Ellicott. The bakery had a deep stone oven; an oil burner heated the bricks. This way of baking was considered outdated and so were the wooden boxes that were used for the rye bread to rise. Stomper’s customers did not notice the outdated equipment; they just wanted their famous rye bread. His son Jack ran a bakery on Oak Street. After his father died he moved to the Ellicott Street Bakery and continued the tradition of baking rye bread using the old family recipe. Stomper’s was known for the hearth-baked bread and many Polish delicacies such asrugalske, plechunki, placki, bobka, and piatzek. All of his goods were made from scratch. He learned his baking skills from an Army baking school during WWI and he also attended a national baking school in Chicago. Jack’s wife Veronica died in 1986. He lost interest in the bakery and his customers were left without their famous rye bread and cakes.

Grundler’s bakery was a popular bakery run by Louis Grundler and later his two sons, Louis and Harold. The shop opened in 1934 but Louis Grundler had been selling baked goods in Batavia long before that. He came to Batavia from Bavaria when he was about 16 years old to work at Schwab’s Bakery in Rochester. In the late ‘20s, he ran a bakery on Jefferson Avenue in Batavia called Scott’s. He was looking for a business to buy and eventually found one in Oakfield. About 1933 Mr. Grundler came back to Batavia and sold baked goods from a shop at 12 Main Street. He continued to bake in Oakfield and brought his baked goods to Batavia by trucks. A year later he leased 52 Main Street and moved his business and all of his equipment to Batavia, the mixing and kneading machine, bread slicer, the bake ovens, and the rest is history. While on shopping trips to Batavia, many county residents would stop at the bakery to pick up a loaf of salt-rising bread, its buttery dinner rolls, or one of its specialty pastries. Grundler’s Bakery served Batavia for more than 30 years.

Saraceni bakery was located on 245 Liberty Street and was built by Arthur Saraceni. Mr. Saraceni baked in his home at 119 Liberty Street from the early ‘30s. The new shop was a little cement block building, which he called The Bake Shop. He sold bread and buns until 1956 when he sold out to Frank Pellegrino.

Francesco Pellegrino, who was the patriarch of the Pellegrino Family, bought Pellegrino Bakery located on 245 Liberty Street from Arthur Saraceni in 1955. Graziano Pellegrino had a bakery business in Reggio Calabria, Italy. In 1955 he came to America. His father Francesco put him in the bakery business with his brothers Rocco, Frank, Joseph, and Carmen. They ran the bakery until 1974 when Graziano suddenly passed on. Graziano’s sons Frank, Rocco, and Vincent, along with Mama Angelina, took over the business and ran it in the proud Pellegrino tradition. Eventually, by 1980 Frank was left to run the business. He moved the business to Center Street then in 1986 to Liberty Street across from the Pok- A- Dot. He built a beautiful new building and the business tripled. In 1991 Pellegrino Bakery closed. In 1999 Pellegrino brothers Frank and Vincent were back with a new building, baking their famous Italian bread, rolls, doughnuts, pizza, pastries, and cookies. In 2001 the business closed. The building and property were sold and the building became the home of Ficcarella Pizza.

Once again a delicious part of our history is gone, but what is left are the scrumptious memories of warm bread, rolls, doughnuts, pastries, and many other delicacies that are perhaps not good for a person to consume in large quantities! Long-time Batavia residents can almost close their eyes and still remember the aromas as you opened the door into these treasures of Batavia’s past.

Author's Note: Not all bakeries are listed in this article but would love to hear from those that were missed.